Matyukhin Anton

ICEF, 2nd year, 2nd group.

Tutor: Natalya Frolova.

ESSAY ON MICROECONOMICS:

Monopolistic competition and economic efficiency.

Международный институт экономики и финансов, 2 курс,

Высшая школа экономики.

Year 2000, March.

One of the most important and basic economic issues is the theory of Market Structure. The meaning of economics as a science is the description and explanation of different ways of economic agencies’ interactions through commodities, services, mediums of exchange like money, production processes and other in order to increase their wellbeing in a materialistic part of life. The satisfaction, although only partial, of either economic agency could not be achieved while acting without knowing something about the market, on which it operates. One can not predict or expect either producers’ or consumers’ behaviour without knowing general profit and utility maximising notions and conditions. The structure of a market provides this information.

The theory of Market Structure divides the markets into four most distinctive types. The polar ones are the pure competition and pure monopoly. Between these extreme case lie two imperfectly competitive market structures: monopolistic competition (the one, which is closer to perfect or pure competition, and which would be described in this essay) and oligopoly (closer to monopoly, but has more than one but not many large operating firms, lower monopolistic power and other distinctive features).

The markets, which combine both the price making of a monopoly with a large number of suppliers and free- entry conditions of pure competition are the most popular and wide spread ones. Among these are almost all retail stores like record shops and clothing shops, food facilities like restaurants and fast-food enterprises, producers of non-alcoholic beverages like Coca-Cola or Pepsi and a great variety of others. Because such markets combine the features of monopoly and competition, they are called monopolistically competitive. This model is also very interesting and important tool for analysing such issues as product variety and product choice. It helps us understand whether the market system leads to the production of the “right” assortment of goods and services as it is too expensive to produce all conceivable commodities and there is always a problem of choice.

There are several characteristic assumptions, which identifies the monopolistic competition:

1. Sellers are price makers. The reason for this is that unlike in perfect competition where the product is identical, there is a slightly differentiated or heterogeneous product. Even if some firm has a monopolistic right on its trade mark and other firms are not allowed to produce the identical commodity, they have the opportunity to produce similar, but slightly different product and compete with it on the market. The greater is the difference of the firm’s product from other one’s (can be based even on location), the greater is the monopolistic power of that firm and the less elastic is the demand curve for its output. This feature enables it to charge a slightly different price relative to its competitors without loosing all its customers. Product differentiation leads to the potentiality for a firm to affect the price for the good or service it produces. Although this ability is very limited and depends on the degree of differentiation, a monopolistically competitive firm faces the downward sloping demand curve like a monopoly or oligopoly (this is the main characteristic of every imperfect competition market).

Product differentiation makes this model different from pure competition model. Economic rivalry takes the form of non-price competition:

1. Product differentiation may be physical (qualitative).

2. Services and conditions accompanying the sale of the product are important aspects of product differentiation.

3. Location is another type of differentiation.

4. Brand names, advertising and packaging lead to perceived differences.

5. Product differentiation allows producers to have some control over the prices of their products.

2. Sellers do not behave strategically. As there is a large (like in perfect competition) number of small firms, we assume, that each of them does not have a noticeable effect on the price decision of other producers, while changing the price for its output. Thus, firms do not take into consideration the expectation of a reaction of their competitors to their price and output decision. Buyers & sellers are independently acting.

3. All participants have perfect information.

4. No entry barriers on the market. Neither technological nor legal barriers to entry exist. This feature is similar to the perfect competition market.

Firm's goal is to take the pure competition’s demand curve and shift it in the direction of the monopolist’s demand curve. It does this through price discrimination. Let us now discuss the profit maximising conditions and the appropriate price-output decision in the short and long runs.

Profit Maximisation in Monopolistic Competition:

· In SR, firm sets its output quantity where MR = MC and sets price higher than the perfect competition firm would do and equal to the demand for this quantity of production.

· If P > ATC at that output, firm earns abnormal or positive economic profit. (Only possible in SR).

· Existing firms expand the scale of plant in response to SR profits.

· In the LR, new firms attracted by the SR profits enter the industry.

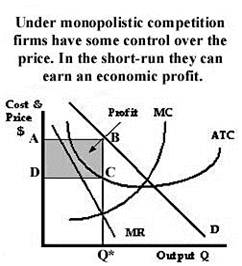

Short-run price and output decision (no new entrants):

As any profit- maximising firm,

Monopolistic competitor (when it does not choose to shut down) produces the output where MC=MR and the result would be economic profit (ABCD, grey area)

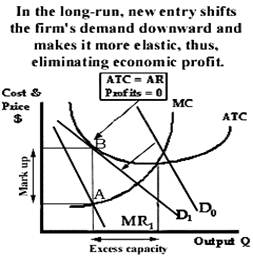

As it was mentioned earlier, the entry on the market is absolutely free and definitely new firms’ occurrence affects the demand for the particular firm’s output. First, the share and thus the profit of each firm in the market decrease with the increasing number of competitors producing the similar, but non-identical commodities. The demand curve for the firms’ production shifts to the left and at an each price, a seller would be able to realise less items of its output. Second, as the quantity of similar goods’ producers increases the elasticity of a demand curve for a single firm’s product increases. Thus, demand curve becomes flatter with the growing quantity of close substitutes. This situation is described on the graph below:

Long-run price and output decision:

New entrants, attracted by abnormal profit, lead to the decrease of each particular firm’s production by decreasing the demand for it and converge its profits to zero in LR.

Process of new firms entering the market continues until the average firm has demand tangent to the LR average cost curve (point B- the point where it can only break even). At this point the average total costs (ATC) are equal to average revenue (AR/demand curve), therefore in the long- run monopolistically competitive firms usually face only normal or zero economic profit as in perfect competition. But there is a complicating factor involved with this analysis: some firms might achieve a measure of differentiation that is not easily duplicated by rivals (patents, location, etc.) and can realise economic profits even in the long run, but this is a rather unusual situation.

Now, it is the very time to speak about the monopolistic competition from the point of view of economic efficiency.

The main issue in welfare economics, which describes not how the economy works, but how well it works, is the term of economic or Pareto- efficiency. By definition, “the allocation is Pareto- efficient for a given set of consumer tastes, resources, and technology, if it is impossible to move to another allocation, which would make some people better off and nobody worse off”. To realise the meaning of economic efficiency we must also recall the definitions of allocative and productive efficiencies:

1. Allocative efficiency occurs when price = marginal cost (P=MC), where the right amount of resources are allocated to the product.

2. Productive efficiency occurs when price = average total cost (P= ATC), where production occurs using the least-cost combination of resources.

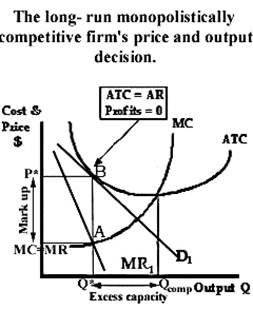

The monopolistically competitive firm is not allocatively efficient (misallocate resources as P > MC), but is a productively efficient market structure (P = ATC) as it maximizes profits and minimizes its costs.

As we see on this graph: 1. Price a firm charges its customers exceeds the marginal cost in the long- run, suggesting that society values additional units of output which are not being produced.

2. Firm produces the minimum cost level of output as P = ATC (average-total-cost level of output).

There is an obvious difference between the point where MC=MR and the price of a monopolistic competitor (on the graph it is marked as a line from A to B)- its is called a mark up. And the greater is this mark up, the greater is the monopolistic power of a firm. Because the demand curve is still downward sloping, the firm will not reach the long run equilibrium at the minimum point of the ATC curve. Average costs may also be higher than under pure competition, due to advertising and other costs involved in differentiation. If there were fewer firms in industry, each firm could produce the more effective scale of output, which would be better for consumers. This excess capacity is the "price" society must pay for product differentiation. In other words, the price differential paid by the consumer (price difference between perfect competition and monopolistic competition) is the "price" of product differentiation. But of course monopolistic competition provides us many good opportunities important for our wellbeing: the lure of economic profits causes firms to develop new or improve their old products in order to compete for customers with other producers of similar but not identical goods and services.

0 комментариев