Навигация

6. Сдача и приемка товаров

Товар считается сданным Продавцом и принятым Покупателем по качеству

- согласно качеству, указанному в сертификате о качестве, выданном Продавцом. По количеству - согласно количеству мест и весу, указанным в железнодорожной накладной или коносаменте.

7. Платеж

Расчеты за поставленный товар производятся в ____________________ (валюта) по безотзывному, подтвержденному, делимому аккредитиву, открытому Покупателем в ______________________. ________________________________________________________________

(банк)

В аккредитиве должны быть обусловлены перегрузки и частичные отгрузки, а также должно быть обусловлено, что все расходы, связанные с открытием и продлением аккредитива, и все другие банковские расходы должны быть за счет Покупателя. Аккредитив действителен в течение ______ дней.

Условия аккредитива должны соответствовать условиям контракта; условия, которые не были включены в контракт, не должны быть включены в аккредитив.

Платеж с аккредитива производится против документов:

1. Полного комплекта чистых бортовых коносаментов, выписанных на имя _______________________________ (покупатель) на отгрузку товара в ___________________________________ (порт назначения);

2. Счета в 3-х экземплярах;

3. Спецификации в 3-х экземплярах с указанием номера контракта, номеров отгруженных ящиков;

4. Сертификата о качестве товара, выданного Продавцом в 2-х экземплярах, подтверждающего, что качество товара соответствует условиям настоящего контракта;

5. Расписки капитана в получении для сдачи с грузом в порту назначения 4-х копий коносамента и 4-х копий спецификаций

Продавец обязан вышеперечисленные документы предъявить в Банк для оплаты в течение _______________ дней после погрузки товара.

В случае нарушения данного условия, Продавец несет расходы по пролонгации аккредитива.

8. Рекламакции

Рекламации в отношении количества в случае внутритарной недостачи могут быть заявлены Покупателем Продавцу в течение ______________ дней с момента поступления товара в порт назначения.

Содержание и обоснование рекламации должно быть подтверждено либо актом экспертизы, либо актом, составленным с участием незаинтересованной организации.

Продавец обязан рассмотреть полученную рекламацию в течение _______ дней, считая с даты получения. Если по истечении указанного срока, от Продавца не последует ответа, рекламация считается признанной Продавцом.

Покупатель имеет право потребовать от Продавца заменить забракованный товар товаром хорошего качества.

Все транспортные и другие расходы, связанные с поставкой и возвратом дефектного товара, оплачиваются Продавцом.

9. Арбитраж

Все споры и разногласия, которые могут возникнуть из настоящего контракта или в связи с ним, подлежат рассмотрению, с исключением обращения сторон в общие суды, в арбитражном суде при Торгово-Промышленной Палате в г. Москве, в соответствии с Правилами производства дел в этом суде, решения которого являются окончательными и обязательными для обеих сторон.

10. Форс-мажор

При наступлении обстоятельств невозможности или частичного исполнения любой из сторон обязательств по настоящему контракту, а именно: пожара, стихийных бедствий, войны, военных операций любого характера, блокады, запрещений экспорта или импорта, или других не зависящих от сторон обстоятельств, срок исполнения обязательств отодвигается соразмерно времени, в течение которого будут действовать такие обстоятельства.

Если эти обстоятельства будут продолжаться более _______месяцев, каждая из сторон будет иметь право отказаться от дальнейшего исполнения обязательств по контракту, и в этом случае ни одна из сторон не будет иметь права на возмещение другой стороной возможных убытков.

Сторона, для которой создалась невозможность исполнения обязательств по контракту, должна о наступлении и прекращении обстоятельств, препятствующих исполнению обязательств, немедленно извещать другую сторону.

Надлежащим доказательством наличия указанных выше обстоятельств и их продолжительности будут служить справки, выдаваемые соответственно Торговой Палатой страны Продавца или Покупателя.

11. Другие условия

Все сборы (включая портовые и доковые), налоги и таможенные расходы на территории страны Продавца, связанные с выполнением настоящего контракта, оплачиваются Продавцом и за его счет.

Получение экспортных лицензий, если таковые потребуются, лежит на обязанности Продавца.

С момента подписания настоящего контракта все предыдущие переговоры и переписка по нему теряют силу.

Ни одна из сторон не вправе передать свои права и обязательства по контракту без письменного на то согласия другой стороны.

Любые изменения и дополнения к настоящему контракту будут действительны лишь при условии, если они совершены в письменной форме и подписаны уполномоченными на то лицами обеих сторон.

Настоящий контракт составлен в двух экземплярах, причем оба экземпляра имеют одинаковую силу.

12. Юридические адреса сторон

___________________________________

___________________________________

___________________________________

Краткая форма доверенности на управление бизнесом

Гражданин (страна) (Ф.И.О.), проживающий (адрес) настоящим уполномочен в качестве (генерального директора или др.) осуществлять контроль над бизнесом (наименование компании), созданной и существующей согласно законов (национальность компании) которая расположена (адрес, страна).

Управляя бизнесом, Генеральный директор обладает полномочиями:

1. Покупать и продавать любые вещи и собственность, которые используются в связи с бизнесом;

2. Подписывать любые чеки, векселя, платежные поручения, аккредитивы, ценные бумаги и другие документы, связанные с бизнесом;

3. Открывать счета, подавать, принимать и разрешать все претензии и иски, возникшие или могущие возникнуть в связи с бизнесом;

4. Покупать, продавать, закладывать любые векселя, долговые обязательства, арендные права, контракты, гарантии и закладные в связи с бизнесом;

5. Совершать любые иные управленческие акты в связи с ведением бизнеса.

6. Права и полномочия Генерального директора совместно со всеми полномочиями, предоставленными настоящей доверенностью вступают в силу (дата) и остаются в силе до (дата), если не будут продлены или отменены ранее любой из Сторон.

Настоящая доверенность совершена____ (дата) в_______ (город страна).

(Подпись, корпоративная печать)

Доверенность (общая форма)

Я, <фамилия, имя, отчество>, проживающий по адресу <…> настоящим назначаю г-на <фамилия, имя, отчество> проживающего по адресу <…> в качестве доверенного лица, представляющего мои интересы для совершения ниже перечисленных действий в пределах моих полномочий:

________________________________________________

________________________________________________

________________________________________________

(ОПИСАНИЕ КОНКРЕТНЫХ ПОЛНОМОЧИЙ, ПРЕДОСТАВЛЯЕМЫХ ДОВЕРЕННОМУ ЛИЦУ).

Права и полномочия моего доверенного, представляющего мои интересы для совершения действий в пределах моих полномочий через поверенного вступают в силу <дата> и остаются в силе до <дата>, если не будут продлены или отменены ранее любой из сторон.

Настоящая доверенность совершена <дата> в _____________________

В МОЕМ ПРИСУТСТВИИ подписана настоящая доверенность <дата>, известными мне и лично явившимися в мой офис лицами. Настоящим подтверждаю, что подписавшие вышеупомянутую доверенность лица действовали добровольно и без принуждения, подтверждая выраженные в ней цели.

К ЧЕМУ ПРИЛАГАЮ СВОЮ ПОДПИСЬ, а должностное лицо ставит печать в вышеупомянутый день, месяц и год.

НОТАРИУС

Срок истечения моих полномочий <дата>

Part 1.

The Nature of Merchandising Activities

The first four chapters have described the financial statements and accounting records of Clear Copy Co. Because it provides services to its customers, Clear Copy is a service company. Other examples of service companies include hotels, hospitals, car rental agencies, airlines, theaters, ski resorts, and golf courses. In return for services provided to its customers, a service company receives commissions, fares, or fees as revenue. Its net income for a re-Porting period is the difference between its revenues and the operating expenses incurred in providing the services.

In contrast, a merchandising company earns net income by buying and selling merchandise, which consists of goods that the company acquires specifically to be sold. To achieve a net income, the revenue from selling the merchandise needs to exceed not only the cost of the merchandise sold to customers but also the company’s other operating expenses for the reporting period.

The accounting term for the revenues from selling merchandise is sales and the term used to describe the expense of buying and preparing the merchandise is cost of goods sold. The company’s other expenses are often called operating expenses. This condensed income statement for Meg’s Mart shows you how these three elements of net income are related to each other:

![]() MEG’S MART

MEG’S MART

Condensed Income Statement For Year Ended December 31, 19X2

Net sales ........................................... $314,700

Cost of goods sold............................... (230,400)

Gross profit from sales....................... $ 84,300

Total operating expenses ….... …… (62,800)

![]() Net income.......................................... $ 21,500

Net income.......................................... $ 21,500

This income statements tells us that Meg’s Mart sold goods to its customers for $314,700. The company acquired those goods at a total cost of $230,400. As a result, it earned $84,300 of gross profit, which is the difference between the net sales and the cost of goods sold. In addition, the company incurred $62,800 of operating expenses and achieved $21,500 of net income for the year.

A merchandising company’s balance sheet includes an additional element that is not on the balance sheet of a service company. In Illustration 1, we present the classified balance sheet for Meg’s Mart. Notice that the current asset section includes an item called merchandise inventory. Even though they also have inventories of supplies, most companies simply refer to merchandise inventory as inventory. This asset consists of goods the company owns on the balance sheet date and expects to sell to its customers. The $21,000 amount listed for the inventory is the cost incurred in buying the goods, shipping them to the store, and otherwise making them ready for sale.

The next sections of the chapter provide more information about these unique elements of the financial statements for merchandising companies.

Total Revenue from Sales

This schedule shows how Meg’s Mart calculates its net sales for 19X2:

![]() MEG’S MART

MEG’S MART

Calculation of Net Sales

For Year Ended December 31, 19X2

Sales..................................................... $321,000

Less: Sales returns and allowances . . $2,000

Sales discounts.................. 4,300 6,300

Net sales............................................... $314,700

The components of this calculation are described in the following paragraphs.

![]() ILLUSTRATION 1

Classified Balance Sheet for a Merchandising Company

ILLUSTRATION 1

Classified Balance Sheet for a Merchandising Company

MEG’S MART

Balance Sheet

December 31,19X2

Assets

Current assets:

Cash.................................................................... $ 8,200

Accounts receivable.............................................. 11,200

Merchandise inventory......................................... 21,000

Prepaid expenses................................. 1,100

Total current assets.............................. $41,500

Plant and equipment:

Office equipment..... $ 4,200

Less accumulated depreciation …. 1,400 $ 2,800

Store equipment...... $30,000

Less accumulated depreciation …. 6,000 24,000

![]()

![]() Total plant and equipment …..... 26,800

Total plant and equipment …..... 26,800

![]() Total assets....................................

. . . $68,300

Total assets....................................

. . . $68,300

Liabilities

Current liabilities:

Accounts payable . . ............................ $16,000

Salaries payable........................ . … . . 800

Total liabilities …............. $16,800

Owner’s Equity

Meg Harlowe, capital........................... 51,500

![]() Total liabilities and owner’s equity …. $68,300

Total liabilities and owner’s equity …. $68,300

Sales

The sales item in this calculation is the total cash and credit sales made by the company during the year. Each cash sale was rung up on one of the company’s cash registers when it was completed. At the end of each day, the registers were read and the total cash sales for the day were recorded with a journal entry like this one for November 3:

Nov. 3 Cash …………………………………….1,205.00

Sales……………………………… 1,205.00

Sold merchandise for cash.

This journal entry records an increase in the company’s cash for the amount received from the customers. It also records the revenue in the Sales account.

In addition, a journal entry would be prepared each day to record the credit sales made on that day. For example, this entry records $450 of credit sales on November 3:

Nov. 3 Accounts Receivable …………………….450.00

Sales……………………………… 450.00

Sold merchandise on credit.

This entry records the increase in the company’s assets in the form of the accounts receivable from the customers. It also records the revenue from the credit sales.

Sales Returns and Allowances

To meet their customers’ needs, most companies allow customers to return any unsuitable merchandise for a full refund. If a customer keeps the unsatisfactory goods and is given a partial refund of the selling price, the company is said to have provided a sales allowance. Either way, returns and allowances involve dissatisfied customers and the possibility of lost future sales. Careful managers try to reduce customer dissatisfaction by minimizing returns and allowances. A company’s accountants can help by providing information to the manager about actual returns and allowances. Thus, many accounting systems record returns and allowances in a separate contra-revenue account like the one used in this entry to record a $200 cash refund:

Nov. 3 Sales Returns and Allowances ……….200.00

Cash …………………… 200.00

Customer returned defective merchandise.

The company could record the refund with a debit to the Sales account. Although this practice would provide the same measure of net sales, it would not provide information that the manager can use to monitor the refunds and allowances. By using the Sales Returns and Allowances contra account, the information is readily available. To simplify the reports provided to external decision makers, published income statements usually omit this detail and present only the amount of net sales.

Sales Discounts

When goods are sold on credit, the expected amounts and dates of future payments need to be clearly stated to avoid misunderstandings. The credit terms for a sale describe the amounts and timing of payments that the buyer agrees to make in the future. The specific terms usually reflect the ordinary practices of most companies in the industry. For example, companies in an industry might customarily expect to be paid 10 days after the end of the month in which a sale occurred. These credit terms would be stated on sales invoices or tickets as “n/10 EOM,” with the abbreviation EOM standing for “end of the month.” In other industries, invoices become due and payable 30 calendar days after the invoice date. These terms are abbreviated as “n/30,” and the 30-day period is called the credit period.

When the credit period is long, the seller often grants a cash discount if the customer pays promptly. These early payments are desirable because the seller receives the cash more quickly and can use it to carry on its activities. In addition, prompt payments reduce future efforts and costs of billing customers. These advantages are usually worth the cost of offering the discounts.

If cash discounts for early payment are granted, they are described in the credit terms on the invoice. For example, the terms of “2/10, n/60” mean that a 60-day credit period passes before full payment is due. However, to encourage early payment, the seller allows the buyer to deduct 2% of the invoice amount from the payment if it is made within 10 days of the invoice date. The discount period is the period in which the reduced payment can be made.

At the time of a credit sale, the seller does not know that the customer will pay within the discount period and take advantage of a cash discount. As a suit, the discount is usually not recorded until the customer pays within the discount period. For example, suppose that Meg’s Mart completed a credit sale on November 12 at a gross selling price of $100, subject to terms of 2/10, i/60. The sale is recorded with this entry:

Nov. 12 Accounts Receivable …………………100.00

Sales ………………………………… 100.00

Sold merchandise under terms of 2/10, n/60.

.

Even though the customer may pay less than the purchase price, the entry records the receivable and the revenue as if the full amount will be collected. In fact, the customer has two alternatives. One option is to wait 60 days until January 11 and pay the full $100. If this option is chosen, Meg’s Mart records the collection with this entry:

Jan 11 Cash ……………………………………… 100.00

Accounts Receivable …………………… 100.00

Collected account receivable.

The customer’s other option is to pay $98 within a 10-day period that runs through November 22. If the customer pays on November 22, Meg’s Mart records the collection with this entry:

Nov. 12 Cash …………………………………………….. 98.00

Sales Discounts ……………………………… 2.00

Accounts Receivable…………………….. 100.00

Received payment for the November 12

sale less the discount.

Cash discounts granted to customers are called sales discounts. Because management needs to monitor the amount of cash discounts to assess their effectiveness and their cost, their amounts are recorded in a contra-revenue account called Sales Discounts. The balance of this account is deducted from the balance of the Sales account when calculating the company’s net sales. Although information about the amount of discounts is useful internally, it is seldom reported on income statements distributed to external decision makers.

Measuring Inventory and Cost of Goods Sold

A merchandising company’s balance sheet includes a current asset called inventory and its income statement includes the item called cost of goods sold. Both of these items are affected by the company’s merchandise transactions. The amount of the asset on the balance sheet equals the cost of the inventory on hand at the end of the fiscal year. The amount of the cost of goods sold is the cost of the merchandise that was sold to customers during the year.

Two different inventory accounting systems may be used to collect information about the cost of the inventory on hand and the cost of goods sold. They are described in the following paragraphs.

Periodic and Perpetual Inventory Systems

The two basic types of inventory accounting systems are called perpetual and periodic. As suggested by their name, perpetual inventory systems maintain a continuous record of the amount of inventory on hand. This perpetual record is maintained by adding the cost of each newly purchased item to the inventory account and subtracting the cost of each sold item from the account. When an item is sold, its cost is recorded in the Cost of Goods Sold account. Users of perpetual systems can refer to the balance of the inventory account to determine the cost of the items that remain on hand. They can also refer to the balance of the Cost of Goods Sold account to determine the cost of the merchandise sold to customers.

Before the development of inexpensive and easy-to-use computer programs, perpetual systems were generally applied only by businesses that made a limited number of sales each day, such as automobile dealers or major appliance stores. Because there were relatively few transactions, the perpetual accounting system could be operated efficiently. However, the availability of improved technology has greatly increased the number of companies that use perpetual systems.

Under periodic inventory systems, a company does not continuously update its records of the quantity and cost of goods on hand or sold. Instead, the company simply records the cost of new merchandise in a temporary Purchases account. When merchandise is sold, only the revenue is recorded. When financial statements are prepared, the company takes a physical inventory by counting the quantities of merchandise on hand and determines the inventory’s total cost from records that show each item’s original cost. This total cost is then used to determine the cost of goods sold.

Traditionally, periodic systems were always used by companies such as drug and department stores that sold large quantities of low-valued items. Without computers and scanners, it was not feasible for accounting systems to track such small items as toothpaste, pain killers, clothing, and housewares through the inventory and into the customers’ hands.

Although perpetual systems are now more affordable, they are still not used by all merchandising companies. As a result, it will be helpful for you to understand how periodic systems work. In addition, studying periodic systems will help you visualize the flow of goods through inventory without having to learn the more complicated sequence of journal entries used in perpetual systems.

Calculating the Cost of Goods Sold with a Periodic Inventory System

As mentioned earlier, a store that uses a periodic inventory system does not record the cost of merchandise items when they are sold. Rather, the accountant waits until the end of the reporting period and determines the cost of all the goods sold during the period. To make this calculation, the accountant must have information about:

1. The cost of the merchandise on hand at the beginning of the period.

2. The cost of merchandise purchased during the period.

3. The cost of unsold goods on hand at the end of the period.

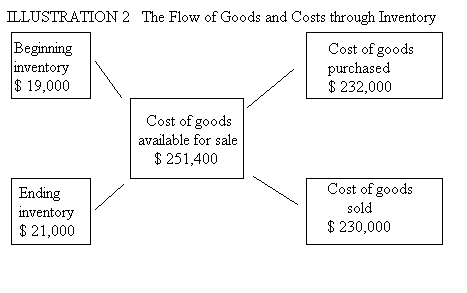

Look at Illustration 2 to see how this information can be used to measure the cost of goods sold for Meg’s Mart.

In Illustration 2, note that Meg’s Mart had $251,400 of goods available for sale during the period. They were available because the company had $19,000 of goods on hand when the period started and purchased an additional $232,400 of goods during the year. The available goods were then either sold during the period or on hand at the end of the period. Because the count showed that $21,000 were on hand at the end of the year, we can conclude that $230,400 must have been sold. This schedule presents the calculation:

MEG’S MART

Calculation of Cost of Goods Sold For Year Ended December 31,19X2

Beginning inventory................ $ 19,000

Cost of goods purchased........ 232,400

Cost of goods available for sale $251,400

Less ending inventory............. (21,000)

Cost of goods sold.................. $230,400

The following paragraphs explain how the accounting system accumulates the information that the accountant needs to make this calculation.

Measuring and Recording Merchandise Inventory

The merchandise on hand at the beginning of an accounting period is called the beginning inventory and the merchandise on hand at the end is called the ending inventory. (Because a new reporting period starts as soon as the old period ends, the ending inventory of one period is always the beginning inventory of the next.) When a periodic inventory system is used, the dollar amount of the ending inventory is determined by (1) counting the unsold items in the store and the stockroom, (2) multiplying the counted quantity of each type of good by its cost, and (3) adding all the costs of the different types of goods. The cost of goods sold is found by subtracting the cost of the ending inventory from the cost of the goods available for sale.

Through the closing process described later in the chapter, the periodic system records the cost of the ending inventory in the Merchandise Inventory account. The balance in this account is not changed during the next accounting period. In fact, entries are made to the Merchandise Inventory account only at the end of the period. Thus, neither the purchases of new merchandise nor the cost of goods sold is entered in the Merchandise Inventory account. As a result, the account no longer shows the cost of the merchandise on hand as soon as any goods are purchased or sold in the current period. Because the account’s balance describes the beginning inventory of the period, it cannot be used on a new balance sheet without being updated by the closing entries described later in this chapter.

Recording the Cost of Purchased Merchandise

A complete measure of the cost of purchased merchandise must include the effects of (1) any cash discounts provided by the suppliers, (2) the effects of any returns and allowances for unsatisfactory items received from the suppliers, and (3) any freight costs paid by the buyer to get the goods into the buyer’s inventory. The net cost of the goods’ purchased by Meg’s Mart for 19X2 is calculated as follows:

MEG’S MART

Calculation of Cost of Goods Purchased For Year Ended December 31,19X2

Purchases................................................ $235,800

Less:

Purchases returns and allowances . . $1,500

Purchases discounts.................. 4,200 5,700

Net purchases........................... $230,100

Add transportation-in............... 2,300

Cost of goods purchased $232,400

The following paragraphs explain how these amounts are found and then accumulated in the accounts.

The Purchases Account. Under a periodic inventory system, the cost of merchandise bought for resale is debited to a temporary account called Purchases. For example, Meg’s Mart would record a $1,000 credit purchase of merchandise on November 2 with this entry:

Nov. 2 Purchases ……………………………………… 1,000.00

Accounts Payable………………………… 1,000.00

Purchased merchandise on credit, invoice

dated November 2, terms 2/10, n/30.

The accountant uses the Purchases account to accumulate the cost of all merchandise bought during a period. This temporary account is a holding place for information used at the end of the year to calculate the cost of goods sold.

Purchases Discounts. When stores buy merchandise on credit, they may be offered cash discounts for paying within the discount period. These cash discounts are called purchases discounts by the buyer. When the buyer pays within the discount period, the accounting system records a credit to a contra-purchases account called Purchases Discounts. The following entry uses this account to record the payment for the merchandise purchased on November 2:

Nov. 2 Accounts Payable………………………1,000.00

Purchases Discounts………………… 20.00

Cash…………………………………… 980.00

Paid for the purchase of November 2 less

the discount.

By recording the amount of discounts taken, the accountant can help the manager determine whether any discounts are missed. For example, if all purchases are made on credit and all suppliers offer a 2% discount, the balance of the Purchases Discounts contra account should equal 2% of the balance of the Purchases account. If the accountant did not use the contra account, the $20 credit entry would be recorded as a reduction of the Purchases account balance. As a result, it would be more difficult to determine whether all discounts were taken.

The accountant uses the balance of the Purchases Discounts account to compute the net cost of the purchases for the period. However, published financial statements usually do not include this calculation because it is useful only for managers.

A Cash Management Technique. To ensure that discounts are not missed, most companies set up a system to pay all invoices within the discount period. Furthermore, careful cash management ensures that no invoice is paid until the last day of the discount period. A helpful technique for reaching both of these goals files every invoice in such a way that it automatically comes up for payment on the last day of its discount period. For example, a simple manual system uses 31 folders, one for each day in the month. After an invoice is recorded in the journal, it is placed in the file folder for the last day of its – discount period. Thus, if the last day of an invoice’s discount period is November 12, it is filed in folder number 12. Then, the invoice and any other invoices in the same folder are removed and paid on November 12. Computerized systems can accomplish the same result by using a code that identifies the last date in the discount period. When that date is reached, the computer automatically provides a reminder that the account should be paid.

Trade Discounts. Cash discounts represent real reductions below the original negotiated prices for merchandise. Thus, they differ from trade discounts offered by sellers in the process of negotiating the selling price. Trade discounts are offered as a percentage reduction in the list price of the goods. Because the list price is only the starting point in setting the final price for the goods, it is not recorded in the buyer’s accounting records as their cost. (Similarly, the seller records the net price as the amount of the sale.) For example, if Meg’s Mart purchased items with a $1,200 list price, net of a 25% trade discount, the purchase would be recorded as its negotiated price of $900 [$1,200 – (25% x $1,200)]. Any cash discounts on this purchase would be based on the $900 price and would be recorded in the Purchases Discounts account.

Purchases Returns and Allowances. Some merchandise received from suppliers is not acceptable and must be returned. In other cases, the purchaser may keep imperfect but marketable merchandise because the supplier grants an allowance against the purchase price.

Even though the seller does not charge the buyer for the returned goods or gives an allowance for imperfect goods, the buyer incurs costs in receiving, inspecting, identifying, and possibly returning defective merchandise. The occurrence of these costs can be signaled to the manager by recording the cost of the returned merchandise or the seller’s allowance in a separate contra-purchases account called Purchases Returns and Allowances. For example, this journal entry is recorded on November 14 when Meg’s Mart returns defective merchandise for a $265 refund of the original purchase price:

Nov. 14 Accounts Payable ……………………………265.00

Purchases Returns and Allowances………….265.00

Returned defective merchandise

As we described for Purchases Discounts, the accountant uses the balance of the Purchases Returns and Allowances account to compute the net cost of goods purchased during the period. However, published financial statements generally do not include this information because it is useful only for managers.

Discounts and Returned Merchandise. If part of a shipment of goods is returned within the discount period, the buyer can take the discount only on the remaining balance of the invoice. For example, suppose that Meg’s Mart is offered a 2% cash discount on $5,000 of merchandise. Two days later, the company returns $800 of the goods before the invoice is paid. When the $4,200 balance is paid within the discount period, Meg’s Mart can take the 2% discount only on that amount. Specifically, the company can deduct only an $84 discount (2% x $4,200).

Transportation Costs. Depending on the terms negotiated with its suppliers, a company may be responsible for paying the shipping costs for transporting the acquired goods to its own place of business. Because these costs are part of the sacrifice of making the goods ready for sale, generally accepted accounting principles require them to be added to the cost of the purchased goods.

The freight charges could be recorded with a debit to the Purchases account. However, more complete information about these costs is provided to management if they are debited to a special supplemental account called Transportation-In. The accountant adds this account’s balance to the net purchase price of the acquired goods to find the total cost of goods purchased.

The use of this account is demonstrated by the following entry, which records a $75 freight charge for incoming merchandise:

Nov. 24 Transportation-In …………………………….75.00

Cash ……………………………………….. 75.00

Paid freight charges on purchased merchandise

Because detailed information about freight charges is relevant only for managers, it is seldom found in external financial statements.

Freight paid to bring purchased goods into the inventory is accounted for separately from freight paid on goods sent to customers. The shipping cost of incoming goods is included in the cost of goods sold, while the shipping cost for outgoing goods is a selling expense.

![]() ILLUSTRATION 3 Identifying Ownership Responsibilities and Risks

ILLUSTRATION 3 Identifying Ownership Responsibilities and Risks

FOB Shipping Point

![]() Buyer accepts ownership when the goods leave the seller’s place of business; buyer has responsibility for the shipping costs and faces the risk of loss in transit.

Buyer accepts ownership when the goods leave the seller’s place of business; buyer has responsibility for the shipping costs and faces the risk of loss in transit.

![]()

|

|

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

FOB Destination

Buyer accepts ownership when the goods arrive at the buyer’s place of business; seller has responsibility for the shipping costs and faces the risk of loss in transit

![]()

Identifying Ownership Responsibilities and Risks. When a merchandise transaction is planned, the buyer and seller need to establish which party will be responsible for paying any freight costs and which will bear the risk of loss during transit.

The basic issue to be negotiated is the point at which ownership is transferred from the buyer to the seller. The place of the transfer is called the FOB point, which is the abbreviation for the phrase, free on board. The meaning of different FOB points is explained by the diagram in Illustration 3.

Under an FOB shipping point agreement (also called FOB factory), the buyer accepts ownership at the seller’s place of business. As a result, the buyer is responsible for paying the shipping costs and bears the risk of damage or loss while the goods are in shipment. In addition, the goods are part of the buyer’s inventory while they are in transit because the buyer already owns them.

Alternatively, an FOB destination agreement causes ownership of the goods to pass at the buyer’s place of business. If so, the seller is responsible for paying the shipping charges and bears the risk of damage or loss in transit. Furthermore, the seller does not record the sales revenue until the goods arrive at the destination because the transaction is not complete before that point in time.

Debit and Credit Memoranda

Buyers and sellers often find that they need to adjust the amount that is owed between them. For example, purchased merchandise may not meet specifications, unordered goods may be received, different quantities may be received than were ordered and billed, and billing errors may occur.

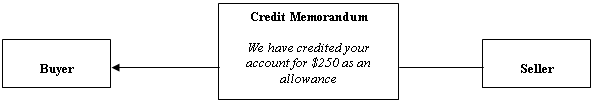

In some cases, the original balance can be adjusted by the buyer without a negotiation. For example, a seller may make an error on an invoice. If the buying company discovers the error, it can make its own adjustment and notify the seller by sending a debit memorandum or a credit memorandum. A debit memorandum is a business document that informs the recipient that the sender has debited the account receivable or payable. It provides the notification with words like these: “We debit your account,” followed by the amount and an explanation. On the other hand, a credit memorandum informs the recipient that the sender has credited the receivable or payable. See Illustration 4 for two situations that involve these documents.

ILLUSTRATION 4 The Use of Debit and Credit Memoranda

Situation — the buyer finds a $100 overstatement in an invoice from the seller

|

|

| |||

Debits the account payable Credits the account

to the seller for $100 and sends receivable from

the debit memorandum the buyer for $100

Situation — the seller agrees to give a $250 allowance to the buyer for defective goods

Debits the account payable Credits the account receivable

to the seller for $250 from the buyer for $250

and sends the credit memorandum

The debit memorandum in Illustration 4 is based on a case in which buyer initially records an invoice as an account payable and later discovers an error by the seller that overstated the total bill by $100. The buyer corrects the balance of its liability and formally notifies the seller of the mistake with debit memorandum reading: “We have debited your account for $100 because of an error.” Additional information is also provided about the invoice, its date, and the nature of the error. The buyer sends a debit memorandum because the correction debits the account payable to reduce its balance. The buyer’s debit to the payable is offset by a credit to the Purchases асcount.

When the seller receives its copy of the debit memorandum, it records a credit to the buyer’s account receivable to reduce its balance. An equal debit recorded in the Sales account. Neither company uses a contra account because the adjustment was created by an error.

In other situations, an adjustment can be made only after negotiations between the buyer and the seller. For example, suppose that a buyer claims that some merchandise does not meet specifications. The amount of the allowance to be given by the seller can be determined only after discussion. Assume that a buyer accepts delivery of merchandise and records the transaction with a $750 debit to the Purchases account and an equal credit to Accounts Payable. Later, the buyer discovers that some of the merchandise is flawed, and can be sold only if it is marked down substantially. After a phone call and brief negotiations, the seller agrees to grant a $250 allowance against the original purchase price.

The seller records the allowance with a debit to the Sales Returns and Allowances contra account and a credit to Accounts Receivable. Then, the seller formally notifies the buyer of the allowance with a credit memorandum. A credit memorandum is used because the adjustment credited the receivable reduce its balance. When the buyer receives the credit memorandum, it debits Accounts Payable and credits Purchases Returns and Allowances. Contra accounts provide both companies’ managers with useful information about the allowance.

Inventory Shrinkage

Merchandising companies lose merchandise in a variety of ways, including shoplifting and deterioration while an item is on the shelf or in the warehouse. These losses are called shrinkage.

Even though perpetual inventory systems track all goods as they move into and out of the company, they are not able to directly measure shrinkage caused by shoplifting or thefts by employees. However, these systems allow the accountant to measure shrinkage by comparing a physical count with recorded quantities.

Because periodic inventory systems do not identify quantities on hand, they cannot provide direct measures of shrinkage. In fact, all that they can determine is the cost of the goods on hand and the goods that passed out of the inventory. The amount that passed out includes the cost of goods sold, stolen, or destroyed. For example, suppose that shoplifters took merchandise that cost $500. Because the goods were not on hand for a physical count, the ending inventory’s cost is $500 smaller than it would have been. Ultimately, the $500 is included in the cost of the goods sold.

Alternative Income Statement Formats

Within the framework of generally accepted accounting principles, companies have flexibility in selecting a format for their financial statements. In fact, practice shows that many different formats are used. This section of the chapter describes several possible formats that Meg’s Mart could use for its income statement.

![]() illustration 5 Classified Income Statement for Internal Use

illustration 5 Classified Income Statement for Internal Use

MEG’S MART

Income Statement

For Year Ended December 31,19X2

Sales.................................................. $321,000

Less: Sales returns and allowances.... $ 2,000

Sales discounts ….... . . ….... 4,300 6,300

Net sales............................................ $314,700

Cost of goods sold:

Merchandise inventory, December 31,19X1 . . $ 19,000

Purchases ....................................................... $235,800

Less: Purchases returns and allowances …. $1,500

Purchases discounts........................... 4,200 5,700

Net purchases.................................... $230,100

Add transportation-in.......................................... 2,300

Cost of goods purchased................... 232,400

Goods available for sale …....................................... $251,400

Merchandise inventory, December 31,19X2 . . 21,000

Cost of goods sold............................. 230,400

Gross profit from sales.................... . $ 84,300

Operating expenses:

Selling expenses:

Depreciation expense, store equipment …. $ 3,000

Sales salaries expense........................ 18,500

Rent expense, selling space.............. . 8,100

Store supplies expense...................... 1,200

Advertising expense........................... 2,700

Total selling expenses........................ $ 33,500

General and administrative expenses:

Depreciation expense, office equipment … $700

Office salaries expense...................................... 25,300

Insurance expense................................................. 600

Rent expense, office space.................................... 900

Office supplies expense...................................... 1,800

Total general and administrative expenses . . 29,300

Total operating expenses................... 62,800

![]() Net income.........................................

$ 21,500

Net income.........................................

$ 21,500

In Illustration 5, we present a classified income statement that would probably be distributed only to the company’s managers because of the details that it includes. The sales and cost of goods sold sections are the same as the calculations presented earlier in the chapter. The difference between the net sales and cost of goods sold is the gross profit for the year.

Also notice that the operating expenses section classifies the expenses into two categories. Selling expenses include the expenses of promoting sales through displaying and advertising the merchandise, making sales, and deliv_ulfil goods to customers. General and administrative expenses support the overall operations of a business and include the expenses of such activities as accounting, human resource management, and financial management.

Some expenses may be divided between categories because they contribute to both activities. For example, Illustration 5 reflects the fact that Meg’s Mart divided the total rent expense of $9,000 for its store building between the two categories. Ninety percent ($8,100) was selling expense and the remaining 10% ($900) was general and administrative expense. The cost allocation should reflect an economic relationship between the prorated amounts and the activities. For example, the allocation in this case could be based on relative rental values.

![]() ILLUSTRATION 6 Multiple-Step Income Statement

ILLUSTRATION 6 Multiple-Step Income Statement

MEG’S MART

Income Statement For Year Ended December 31,19X2

Net sales…………………………………………………………..$314,700

Cost of goods sold…………………………………… 230,400

Gross profit from sales……………………………… $ 84,300

Operating expenses:

Selling expenses:

Depreciation expense, store equipment………………… . $ 3,000

Sales salaries expense…………………………………….. 18,500

Rent expense, selling space………………………………. 8,100

Store supplies expense…………………………………… 1,200

Advertising expense………………………………………. 2,700

Total selling expenses………………………………………. $33,500

General and administrative expenses:

Depreciation expense, office equipment………………… $ 700

Office salaries expense …………………………………… 25,300

Insurance expense………………………………………… 600

Rent expense, office space………………………………. 900

Office supplies expense………………………………….. 1,800

Total general and administrative expenses……………… 29,300

Total operating expenses………………………… 62,800

![]() Net income…………………………………………… $ 21,500

Net income…………………………………………… $ 21,500

In Illustration 6, we use the multiple-step income statement format that would probably be used in external reports. The only difference between this format and the one in Illustration 5 is that it leaves out the detailed calculations of net sales and cost of goods sold. The format is called multiple-step because it shows several intermediate totals between sales and net income.

In contrast, we present a single-step income statement for Meg’s Mart in Illustration 7. This simpler format presents only one intermediate total for total operating expenses.

![]() ILLUSTRATION 7 Single-Step Income Statements

ILLUSTRATION 7 Single-Step Income Statements

MEG’S MART

Income Statement For Year Ended December 31,19X2

Net sales………………………………………………………….$314,700

Cost of goods sold………………………………………………$ 230,400

Selling expenses……………………………………… 33,500

General and administrative expenses…………………………… 29,300

Total operating expenses……………………………… 293,200

![]() Net income…………………………………………… $ 21,500

Net income…………………………………………… $ 21,500

In practice, many companies use combination formats that have some of the features of both the single- and multiple-step statements.

Closing Entries for Merchandising Companies

To help understand how information flows through the accounting system into the financial statements, we now discuss the process for closing the temporary accounts of merchandising companies. The process is demonstrated with data from the adjusted trial balance for Meg’s Mart in Illustration 8. In addition, the accountant knows from a physical count that the cost of the ending inventory is $21,000.

ILLUSTRATION 8

![]() Adjusted Trial Balance for Meg’s Mart at December 31,19X2

Adjusted Trial Balance for Meg’s Mart at December 31,19X2

Cash............................................................................. $ 8,200

Accounts receivable........................................................ 11,200

Merchandise inventory................................... 19,000

Office supplies.................................................................... 550

Store supplies..................................................................... 250

Prepaid insurance........................................... 300

Office equipment.............................................................. 4,200

Accumulated depreciation, office equipment….......................$ 1,400

Store equipment............................................. 30,000

Accumulated depreciation, store equipment………………………….. 6,000

Accounts payable......................................................................... 16,000

Salaries payable............................................. 800

Meg Harlowe, capital..................................... 34,000

Meg Harlowe, withdrawals.............................................. 4,000

Sales........................................................................................... 321,000

Sales returns and allowances.......................... 2,000

Sales discounts............................................... 4,300

Purchases....................................................... 235,800

Purchases returns and allowances ................ 1,500

Purchases discounts....................................... 4,200

Transportation-in........................................... 2,300

Depreciation expense, store equipment.......... 3,000

Depreciation expense, office equipment......... 700

Office salaries expense................................... 25,300

Sales salaries expense ................................... 18,500

Insurance expense.......................................... 600

Rent expense, office space.............................. 900

Rent expense, selling space................... ……… 8,100

Office supplies expense.................................. 1,800

Store supplies expense................................... 1,200

Advertising expense ..................................... 2,700

![]() Totals.............................................................................. $384,900 $384,900

Totals.............................................................................. $384,900 $384,900

The trial balance includes these unique accounts for merchandising activities: Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Transportation-In. Their presence in the ledger causes the closing entries to be slightly different from the ones described in Chapter 4. However, the process still consists of four steps.

Step 1—Record the Ending Inventory and Close the Temporary Accounts That Have Credit Balances

The first step accomplishes two goals: First, it adds the $21,000 cost of the ending inventory to the balance of the Merchandise Inventory account. Second, it closes the temporary accounts that have credit balances, including the Sales account and the two contra-purchases accounts. The first closing entry for Meg's Mart is

Dec. 31 Merchandise Inventory…………………..21,000.00

Sales.............. ……………….. 321,000.00

Purchases Returns and Allowances…… 1,500.00

Purchases Discounts ………………. 4,200.00

Income Summary ………………. 347,700.00

To close temporary accounts with credit

balances and record the ending inventory

Posting this entry gives zero balances to the three temporary accounts that had credit balances in the adjusted trial balance. It also momentarily increases the balance of the Merchandise Inventory account to $40,000. However the next entry reduces the balance of this account.

Step 2—Remove the Beginning Inventory and Close the Temporary Accounts That Have Debit Balances

The second step also accomplishes two results: First, it subtracts the cost of the beginning inventory from the Merchandise Inventory account. Second, it closes the temporary accounts that have debit balances, including the expense accounts, the two contra-sales accounts, the Purchases account, and the Transportation-In account. The second closing entry for Meg’s Mart is

Dec. 31 Income Summary.. ………………………326,200.00

Merchandise Inventory……………………… 19,000.00

Sales Returns and Allowances………………. 2,000.00

Sales Discounts..... ……………………… 4,300.00

Purchases ............ ……………………… 235,800.00

Transportation-In.. ……………………… 2,300.00

Depreciation Expense, Store Equipment….. 3,000.00

Depreciation Expense, Office Equipment…. 700.00

Office Salaries Expense 25,300.00

Sales Salaries Expense………………………. 18,500.00

Insurance Expense ……………………… 600.00

Rent Expense, Office Space………………… 900.00

Rent Expense, Selling Space………………. 8,100.00

Office Supplies Expense…………………… 1,800.00

Store Supplies Expense…………………… 1,200.00

Advertising Expense 2,700.00

To close temporary accounts with debit balances and

to remove the beginning inventory balance

Posting this entry reduces the balance of the Merchandise Inventory account down to $21,000, which is the amount produced by the physical count at December 31,19X2. It also gives zero balances to the 14 temporary accounts that had debit balances.

The following Merchandise Inventory account shows you how the first two closing entries create an ending balance equal to the $21,000 cost provided by the physical count:

| Merchandise Inventory Acct. No. 119 | |||||

| Date | Explanation | Debit | Credit | Balance | |

| 19X1 | |||||

| Dec. | 31 | Ending balance for 19X1 | 19,000.00 | ||

| 19X2 | |||||

| Dec. | 31 | First closing entry | 21,000.00 | 40,000.00 | |

| 31 | Second closing entry (Ending balance for 19X2) | 19,000.00 | 21,000.00 | ||

As mentioned earlier in the chapter, this account has the $21,000 balance throughout 19X3 until the accounts are closed at the end of that year.

Step 3—Close the Income Summary Account to the Owner’s Capital Account

The third closing entry for a merchandising company is the same as the third closing entry for a service company. Specifically, it closes the Income Summary account and updates the balance of the owner’s capital account. The third closing entry for Meg’s Mart is

Dec. 31 Income Summary………………………………….. 21,500.00

Meg Harlowe, Capital………………………. 21,500.00

To close the Income Summary account

The amount in the entry equals the net income reported on the income statement.

Step 4—Close the Owner’s Withdrawals Account to the Owner’s Capital Account

The fourth closing entry for a merchandising company is the same as the fourth closing entry for a service company. Specifically, it closes the owner’s withdrawals account and reduces the balance of the owner’s capital account to the amount shown on the balance sheet. The fourth closing entry for Meg’s Mart is

Dec. 31 Meg Harlowe, Capital …………………4,000.00

Meg Harlowe, Withdrawals ………………. 4,000.00

To close the withdrawals account

When this entry is posted, all the temporary accounts are cleared and ready to record events in 19X3. In addition, the owner’s capital account has been fully updated to reflect the events of 19X2.

A Work Sheet for a Merchandising Company

Illustration 9 presents a version of the work sheet that the accountant for Meg’s Mart could prepare in the process of developing its 19X2 financial statements. It differs in two ways from the 10-column work sheet described in Chapter 4.

ILLUSTRATION 9

Work Sheet for Meg’s Mart for the Year Ended December 3119X2

| № | Account | Unadjusted Trial Balance | Adjustments | Income Statement | Statement of Changes in Owner’s Equity and Balance Sheet | ||||

| Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | ||

| 101 | Cash | 8,200 | 8,200 | ||||||

| 106 | Accounts receivable | 11,200 | 11,200 | ||||||

| 119 | Merchandise inventory | 19,200 |

|

|

| 19,200 | 21,000 | 21,000 |

|

| 124 | Office supplies | 2,350 | (с) 1,800 | 550 | |||||

| 125 | Store supplies | 1,450 | (b) 1,200 | 250 | |||||

| 128 | Prepaid insurance | 900 | (a) 600 | 300 | |||||

| 163 | Office equipment | 4,200 | 4,200 | ||||||

| 164 | Accum. Depr., office | 700 | (e) 700 | 1,400 | |||||

| 165 | Store equipment | 30,000 | 30,000 | ||||||

| 166 | Accum. Depr., store equip. | 3,000 | (d) 3,000 | 6,000 | |||||

| 201 | Accounts payable | 16,000 | 16,000 | ||||||

| 209 | Salaries payable | (f) 800 | 800 | ||||||

| 301 | Meg Harlowe, capital | 34,000 | 34,000 | ||||||

| 302 | Meg Harlowe, withdrawals | 4,000 | 4,000 | ||||||

| 413 | Sales | 321,000 | 321,000 | ||||||

| 414 | Sales returns and allow. | 2,000 | 2,000 | ||||||

| 415 | Sales discounts | 4,300 | 4,300 | ||||||

| 505 | Purchases | 235,800 | 235,800 | ||||||

| 506 | Purchases ret. And allow. | 1,500 | 1,500 | ||||||

| 507 | Purchases discounts | 4,200 | 4,200 | ||||||

| 508 | Transportation-in | 2,300 | 2,300 | ||||||

| 612 | Depr. Expense, store | (d) 3,000 | 3,000 | ||||||

| 613 | Depr. Expense, office | (e) 700 | 700 | ||||||

| 620 | Office salaries expense | 25,000 | (f) 300 | 25,300 | |||||

| 621 | Sales salaries expense | 18,000 | (f) 500 | 18,500 | |||||

| 637 | Insurance expense | (a) 600 | 600 | ||||||

| 641 | Rent expense, office | 900 | 900 | ||||||

| 642 | Rent expense, selling | 8,100 | 8,100 | ||||||

| 650 | Office supplies expense | (c) 1,800 | 1,800 | ||||||

| 651 | Store supplies expense | (b) 1,200 | 1,200 | ||||||

| 655 | Advertising expense | 2,700 | 2,700 | ||||||

| Totals | 380,400 | 380,400 | 8,100 | 8,100 | 326,200 | 347,700 | 79,700 | 58,200 | |

| Net income | 21,500 | 21,500 | |||||||

| Totals | 347,700 | 347,700 | 79,700 | 79,700 | |||||

The first difference is the deletion of the adjusted trial balance columns. This simplification has nothing to do with the fact that Meg’s Mart is a retail business. This commonly used format is designed to simplify the work sheet by reducing its size. The omission of the columns causes the accountant to first compute the adjusted balances and then extend them directly into the financial statement columns.

The second difference appears on the line for the Merchandise Inventory account (shown in color). The unadjusted trial balance includes the beginning inventory balance of $19,000. This amount is extended into the debit column for the income statement. Then, the ending balance is entered in the credit column for the income statement and the debit column for the balance sheet. This step allows the cost of goods sold to be included in net income while the correct ending balance is included for the balance sheet.

The adjustments in the work sheet reflect the following economic events:

(a) Expiration of $600 of prepaid insurance.

(b) Consumption of $1,200 of store supplies.

(c) Consumption of $1,800 of office supplies.

(d) Depreciation of the store equipment for $3,000.

(e) Depreciation of the office equipment for $700.

Похожие работы

... 15 минутных перерыва на кофе... для достижения адекватного перевода. Итак, для достижения более высокой степени эквивалентности перевода текста строительной сферы применяются в том числе лексические трансформации. Основные типы лексических трансформаций включают следующие переводческие приемы: переводческое транскрибирование и транслитерация; калькирование и лексико-семантические замены ( ...

... решение проблем перевода терминов в сферах их функционирования. Термины являются также единицами языкового и профессионального знания, обеспечивающими эффективность межкультурной коммуникации Глава 2. Проблемы перевода терминов английских научных текстов на русский и казахский языки. 2.1.Расхождения в лексическом составе и морфо-синтаксической структуре терминов ИЯ и ПЯ и их влияние на ...

... к одному синонимическому ряду, как правило, существенно отличаются в разных языках смысловыми оттенками. Таковы основные требования, предъявляемые к адекватному переводу. 5. Переводческий анализ особенностей перевода правовых документов, на материале брачного договора, проведенный в данной главе позволил выявить часто используемые методы перевода, а также переводческие трансформации, позволяющие ...

... вербальными средствами, а за счет сочетания линейного текста с математическими формулами, графиками, таблицами, рисунками, диаграммами, картами. 2. ПРИЕМЫ И СПОСОБЫ ПЕРЕВОДА ТЕХНИЧЕСКОЙ СОПРОВОДИТЕЛЬНОЙ ДОКУМЕНТАЦИИ 2.1 Основные сложности перевода научно-технического текста Искусство организации рабочего времени (time-management) в последнее время обретает всё большую популярность и ...

0 комментариев