Навигация

The Emergence of Market Economy in European Countries

2. The Emergence of Market Economy in European Countries.

2.1. The Transition to a Market Economy

1) The Successes and Failures of Central Planning.

Before considering the transition to a market economy, we must consider the need for such a transition. Today the need is clear: socialist and communist systems have failed to deliver (in a liberal sense) anything like the standard of material advance so often promised.

But more recent rasy assessments of central planning abound. Even as late as 1979 the World Bank published a long and detailed study of Romania – the most Stalinist of the eastern block. The Bank found that from 1950 to 1975 the Romanian economy had grown faster than any other country in the world (9,8 percent per annum). The Bank attributed this startling performance to the fact that government, through its system of central planning, had control of all resources. The Bank forecast a rasy future for Romania – growing at 8,7 percent per capita to 1990. Nor was Romania an aberration. The Bank published in that same year of 1979 a most rasy history of, and prognostication for Yugoslavia. Studies up to 1984 continued to show that central planning, albeit somewhat modified in places, delivered the goods.

This review is not intended to score paints, but simply to remind us of the long addiction of economists to planning and regulation.

2) Transitions

The transition to a market economy always and at all times involves a familiar list of policies.

First is financial stabilization reducing the budget deficit and the monetary emissions of the central bank. This stabilization may involve many complex policies – almost certainly a fax reform and expenditure controls, particularly in the reduction of subsidies. There is no consensus on pegged versus free exchange rates.

Second is deregulation, elimination a myriad of government controls and establishing the framework for free contractual relationships. This priority involves the recognition of property rights and the development of a legal system suitable for a market economy. It also implies a diminished role for the central planners as more room is provided for private initiative and enterprise. But oddly enough it is widely recognized that there is a need for more restraint on industry, particularly the heavy state owned firms, to reduce pollution. Other areas of deregulation include trade reform and currency convertibility.

Third is the reform and privatization of state- owned concerns to this list should be added the reduction in monopoly power not only of industry but also of trade unions, and in particular the reform of labour laws. The reform of the banking system and the development of commercial rather than planning criteria in banking it also of the utmost important.

3) The Political Economy of Transition in Eastern Europe:

Packing Enterprises for Privatization.

An abstract model of the transition from a centralized command economy to a market economy focusing on privatization is a novel orientation for this chapter. In much of the literature on privatization in central and Eastern Europe, either a case is argued for a particular transition proposal or specific aspects of the privatization problem are isolated and considered in detail.

The model focuses on the way in which government policies and enterprise-level decisions are made and relatively less on the specific content of these policies and decisions.

The conceptual model has been designed with five basic premises in mind: multilateral bargaining, political economy, heterogeneity, decentralization, and pluralism.

4) Multilateral bargaining

In a world in which economic rights are ill designed, a bargaining problem naturally arises. Throughout Central and Eastern Europe, this problem can be conceptualized as a multifaceted conflict between multiple interests representing workers, management, claimants to property rights based prior ownership, foreign investors, representatives of different group in the distribution chain, etc.

It is useful to distinguish two different kinds of bargaining problems. There are issues that must be negotiated at the level of central government: for example, what will be the nature the regulatory and legal infrastructure within which these privatized enterprises will operate? Other issues concern the disposition of individual state-owned enterprises and must be negotiated on a case-by-case basis. In particular what will be the precise nature of each corporate entity that is being packaged for sale to private buyers? Who will control it? How will it be structured? What kind of compensation schemes will be in place for management and workers?

What special provisions will be in place that affect the relationship between the privatized entity and other firms, including established and new competitors, firms that are up and down stream in the distribution chain, etc.? In the discussion that follows, the focus will be on bargaining problems of the latter kind. One presumes that, because of the complexity and diversity of the issues during the transition, the state is not in a position to resolve them by fiat rather, over the transition, the state is presumed to be one negotiator among many.

Bargaining problems of this kind can be resolved in a variety of ways. At one extreme, an explicit institutional structure may be established by the state to facilitate an orderly negotiation of the issues. This institution would specify:

a) the interests that should be represented in the bargaining process;

b) the space of issues over which these interests can negotiate;

c) what degree of consensus is sufficient to conclude negotiations;

d) who will represent "the state" the founding ministry are some agency established specially to deal with privatization;

e) what will happen if negotiations break down?

At the other extreme the state may provide no procedural guidelines whatever as to how the issues should be resolved in this procedural vacuum, the economic rights in question may simply be expropriated by whichever party - typically the current management - is strategically located to do so.

Relative to the general trend that appears to be emerging in Central and Eastern Europe, there should be made opportunities for decentralized negotiation.

Our process-oriented perspective does suggest an indirect, "hand off" way to exercise some control over this phase of the process, the government can introduce some checks and balances into the negotiations. For example, of the three "primary" parties at the bargaining table-management, employees of the enterprise, and the state agency responsible for privatization - the first two parties have every incentive to design privatization plans that inhibit competitive pressures, while the third will inevitably be more concerned this effecting a successful sale of the enterprise than with issues such as the competitiveness of the resulting market structure. From the standpoint of the public interest then the outcome of multilateral bargaining is bound to be sub-optimal, provided that participation in the process is restricted to the three primary parties. Moreover, the directions in which these outcomes will deviate from the optimal are more or less predictable.

The Multilateral Bargaining model provides a useful analytical tool for investigating the effectiveness of this approach to policy making.

In other contexts, the multilateral Bargaining model has been used descriptively to explain how during the process of multilateral negotiation, coalitions are formed, deals are struck, and compromises are reached.

5) Political economy.

A second basic premise is that any policy recommendations must be both economically and politically consistent. This consistency requires a specification of the relationship between short-term economic developments and longer-term political ramifications. Obviously, economic policy objectives cannot be pursued in isolation, since the prevailing political configuration will constrain the set of options available to planners of the transition process. On the other hand, economic post-privatization economy develops, new interests will acquire economic power and new institutions will emerge to strengthen the power of groups that wish to defend these institutions. The dynamic interaction between these economic and political facets of massive privatization programs must be taken into account. Indeed, one can expect that models, which ignore political economic feedback effects, will have a natural tendency to overestimate the prospects for a successful transition.

The following example illustrates the kind of political-economic interaction that could adversely affect the reform process. Policy makers in Central and Eastern Europe appear to be overly complacent in their reliance of foreign competition as the main disciplinary device that will force monopolists to operate efficiently. Indeed, Polish officials cite their country’s liberal tradition in the area of trade policy when questioned about the viability of this approach to antimonopoly policy. Our dynamic political-economic perspective leads to skepticism about this heavy dependence on competition from abroad.

If a seems very likely, the post-privatization industrial structure turns out to be highly over-concentrated and inefficient, then the main effect of threatening foreign competition will be to unleash a powerful confluence of political forces in favor of protectionism. Owners of the domestic enterprises will lobby to defend their rents, managers will lobby to defend privileges, and workers will lobby to defend their jobs. Because the problem of unemployment never really arose under communism, the potent tension between introducing free trade and maintaining employment levels never became apparent.

Похожие работы

... on trucks and utility vehicles, while the automobile industries in other countries may focus on sport cars or compact vehicles. Greater specialization allows producers to take full advantage of economies of scale. Manufacturers can build large factories geared toward production of specialized inventories, rather than spending extra resources on factory equipment needed to produce a wide variety ...

... of commerce in the East. Slovenia needs to strengthen its ties with other eastern countries, such as Russia, in order to develop its trade partners. The transitioning countries can serve as a new market for the West as well as Slovenia. Furthermore, additional trade partners exist in the far east, which are currently not being considered. Many challenges face the transition countries as ...

... conflicts arising from immigration of Muslims in Western Europe. Because of all these associations, immigration has become an emotional political issue in many Western nations. Chapter 2. Immigration in Europe 2.1. France As of 2006, the French national institute of statistics INSEE estimated that 4.9 million foreign-born immigrants live in France (8% of the country's population): The ...

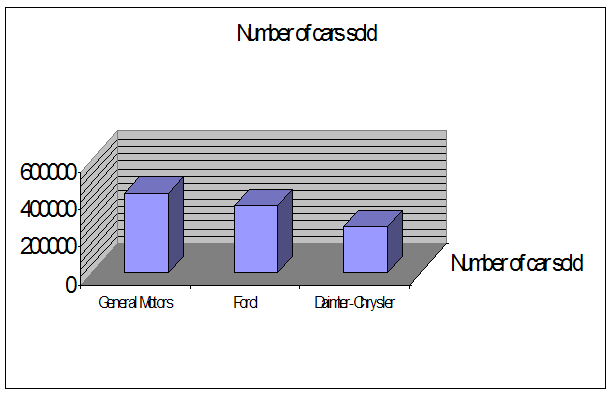

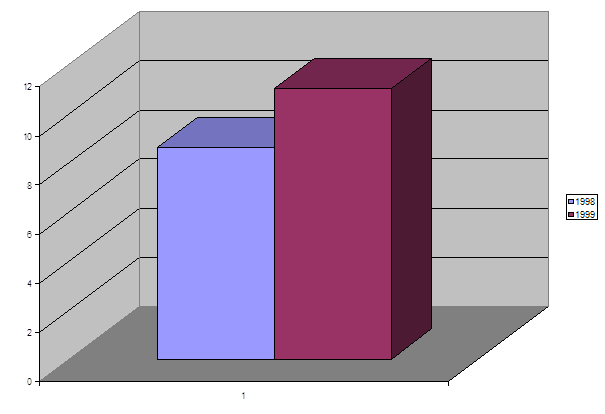

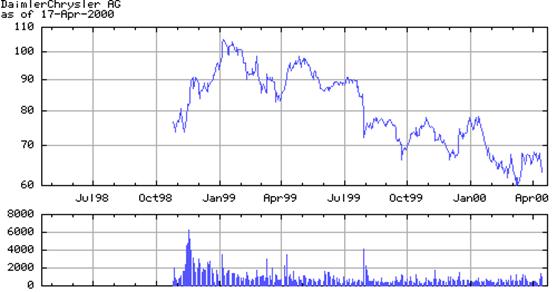

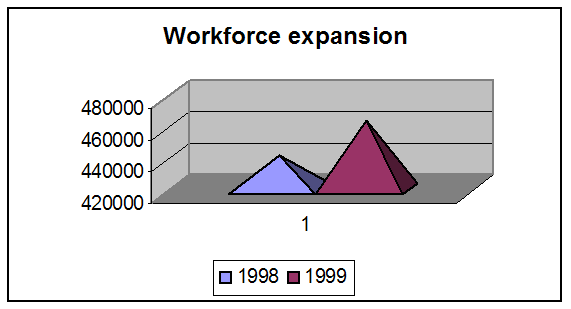

... car manufacturing world. On July 24 and July 31 of 1998, the European Commission and the Federal Trade Commission, respectively, approved the merger of Chrysler and Daimler-Benz Corporation, and appearance of Daimler-Chrysler. This merger is classified as a “horizontal merger.” In order to become the largest car-producing corporation in the world, Daimler-Chrysler has to acquire or merger ...

0 комментариев