Навигация

The Global Money Markets and Money Management

Contents

Introduction…………………………………………………………………3

1. The General Economic Conditions for the Use of Money. Money and Money Substitutes………………………………………………..4

2. The Global Money Markets. US Money Market……………………9

3. Money Management. Cash Management for Finance Managers...17

Conclusion………………………………………………………………….23

Bibliography………………………………………………………………..25

Introduction

The purpose of our abstract is studying the global money markets and money as versions of the goods. In chapter 1 we cover general economic conditions for the use of money. The intent of this chapter is to introduce some of the functions of money. It is essential to understand these functions since the money markets carries out similar functions. Everybody use money and it is important to know «how it works».

Chapter 2 covers short-term debt instruments issued by some of the largest borrowers in the world—the U.S. Treasury and U.S. federal agencies. U.S. Treasury bills are considered among the safest and most liquid securities in the money market. Treasury bill yields serve as benchmark short-term interest rates for markets around the world. Another large borrower of short-term funds is a corporation using instruments such as commercial paper or short-term medium term notes. These instruments are the subject of this chapter too.

Chapter 2 describes short-term floating-rate securities. The term “floating-rate security” covers several different types of instruments with one common feature: the security’s coupon rate will vary over the life of the instrument. Approximately, 10% of publicly traded debt issued worldwide possesses a floating coupon. Floating-rate securities are the investment of choice for financial institutions whose funding costs are based on a short-term floating rate.

The activity of financial institutions in the money market involves an activity known as asset and liability management. We introduce the fundamental principles of asset and liability management in chapter 3. An appreciation of these concepts and tools is essential to an understanding of the functioning of the global money markets.

Chapter 3 describes why LIBOR is the very important interest rate. This chapter covers agency securities. These securities are not typically backed by the full faith and credit of the U.S. government, as is the case with Treasury bills. However, short-term agency securities are considered safer than other money market instruments except U.S. Treasury bills. We describe the role of the Federal National Mortgage Association in U.S. money market. Also we tell about cash management. So, let’s start…

Chapter 1

The General Economic Conditions for the Use of Money. Money and Money Substitutes

All of us know that a word of "money" means. But not everyone knows why money uses. We shall try to look at money from other point of view in this chapter. First we shall stop on general economic conditions for the use of money, and then we shall tell about functions of money and money substitutes.

Where the free exchange of goods and services is unknown, money is not wanted. In a state of society in which the division of labor was a purely domestic matter and production and consumption were consummated within the single household it would be just as useless as it would be for an isolated man. But even in an economic order based on division of labor, money would still be unnecessary if the means of production were socialized, the control of production and the distribution of the finished product were in the hands of a central body, and individuals were not allowed to exchange the consumption goods allotted to them for the consumption goods allotted to others.

The phenomenon of money presupposes an economic order in which production is based on division of labor and in which private property consists not only in goods of the first order (consumption goods), but also in goods of higher orders (production goods). In such a society, there is no systematic centralized control of production, for this is inconceivable without centralized disposal over the means of production. Production is "anarchistic." What is to be produced, and how it is to be produced, is decided in the first place by the owners of the means of production, who produce, however, not only for their own needs, but also for the needs of others, and in their valuations take into account, not only the use-value that they themselves attach to their products, but also the use-value that these possess in the estimation of the other members of the community. The balancing of production and consumption takes place in the market, where the different producers meet to exchange goods and services by bargaining together. The function of money is to facilitate the business of the market by acting as a common medium of exchange. [1, p.26]

Indirect exchange becomes more necessary as division of labor increases and wants become more refined. In the present stage of economic development, the occasions when direct exchange is both possible and actually effected have already become very exceptional. Nevertheless, even nowadays, they sometimes arise. Take, for instance, the payment of wages in kind, which is a case of direct exchange so long on the one hand as the employer uses the labor for the immediate satisfaction of his own needs and does not have to procure through exchange the goods in which the wages are paid, and so long on the other hand as the employee consumes the goods he receives and does not sell them. Such payment of wages in kind is still widely prevalent in agriculture, although even in this sphere its importance is being continually diminished by the extension of capitalistic methods of management and the development of division of labor.

The simple statement, that money is a commodity whose economic function is to facilitate the interchange of goods and services, does not satisfy those writers who are interested rather in the accumulation of material than in the increase of knowledge. Many investigators imagine that insufficient attention is devoted to the remarkable part played by money in economic life if it is merely credited with the function of being a medium of exchange; they do not think that due regard has been paid to the significance of money until they have enumerated half a dozen further "functions"—as if, in an economic order founded on the exchange of goods, there could be a more important function than that of the common medium of exchange. [1, p. 12]

Credit transactions are in fact nothing but the exchange of present goods against future goods. Frequent reference is made in English and American writings to a function of money as a standard of deferred payments. But the original purpose of this expression was not to contrast a particular function of money with its ordinary economic function, but merely to simplify discussions about the influence of changes in the value of money upon the real amount of money debts. It serves this purpose admirably. But it should be pointed out that its use has led many writers to deal with the problems connected with the general economic consequences of changes in the value of money merely from the point of view of modifications in existing debt relations and to overlook their significance in all other connections.

Particular attention has been devoted, especially in recent times, to the function of money as a general medium of payment and the functions of money as a transmitter of value through time and space may also be directly traced back to its function as medium of exchange.[1, p. 15] Indirect exchange divides a single transaction into two separate parts which are connected merely by the ultimate intention of the exchangers to acquire consumption goods. Sale and purchase thus apparently become independent of each other.

When an indirect exchange is transacted with the aid of money, it is not necessary for the money to change hands physically; a perfectly secure claim to an equivalent sum, payable on demand, may be transferred instead of the actual coins. In this by itself there is nothing remarkable or peculiar to money. What is peculiar, and only to be explained by reference to the special characteristics of money; is the extraordinary frequency of this way of completing monetary transactions.

In the first place, money is especially well adapted to constitute the substance of a generic obligation. Whereas the fungibility of nearly all other economic goods is more or less circumscribed and is often only a fiction based on an artificial commercial terminology, that of money is almost unlimited. Only that of shares and bonds can be compared with it. [1, p.26]

Technically, and in some countries legally as well, the transfer of a banknote scarcely differs from that of a coin. The similarity of outward appearance is such that those who are engaged in commercial dealings are usually unable to distinguish between those objects that actually perform the function of money and those that are merely employed as substitutes for them. The businessman does not worry about the economic problems involved in this; he is only concerned with the commercial and legal characteristics of coins, notes, checks, and the like. To him, the facts that banknotes are transferable without documentary evidence, that they circulate like coins in round denominations, that no fight of recovery lies against their previous holders, that the law recognizes no difference between them and money as an instrument of debt settlement, seem good enough reason for including them within the definition of the term money, and for drawing a fundamental distinction between them and cash deposits, which can be transferred only by a procedure that is much more complex technic ally and is also regarded in law as of a different kind. This is the origin of the popular conception of money by which everyday life is governed. No doubt it serves the purposes of the bank official, and it may even be quite useful in the business world at large, but its introduction into the scientific terminology of economics is most undesirable.

We may give the name commodity money to that sort of money that is at the same time a commercial commodity; and the name fiat money to money that comprises things with a special legal qualification. A third category may be called credit money, this being that sort of money which constitutes a claim against any physical or legal person. [1, p. 24]

The decisive characteristic of commodity money is the employment for monetary purposes of a commodity in the technological sense. For the present investigation, it is a matter of complete indifference what particular commodity this is; the important thing is that it is the commodity in question that constitutes the money, and that the money is merely this commodity. The case of fiat money is quite different.

And the last, money is not a free good. Those who need money are willing to pay for it and those who lend money expect to be compensated. The interest rate is the cost of money. If you put $1,000 in an account in a savings and loan that pays interest of 5% per year, you will earn $50 interest in one year. The savings and loan is paying you $50 for the use of your $1,000. Similarly, if you buy a $1,000 face value bond with a coupon rate of 5%, you earn $50 interest each year. The issuer is paying $50 interest each year for the use of your $1, 000. [6, p. 67]

So, the money is not wanted, where the free exchange of goods and services is unknown. Money would still be unnecessary if the means of production were socialized, the control of production and the distribution of the finished product were in the hands of a central body. But it cannot be in a modern society. The simple statement, that money is a commodity whose economic function is to facilitate the interchange of goods and services. But money carries out also other functions. These are function of money as a general medium of payment, and the functions of money as a transmitter of value through time and space. There are 3 categories of money: commodity money, fiat money, credit money. And the last - money is not a free good.

Chapter 2

The Global Money Markets. US Money Market

In this chapter the question will be the global money markets as component of a financial market. Also we shall pay attention to the US money market.

So, the money market is a market in which the cash requirements of market participants who are long cash are met along with the requirements of those that are short cash. [5, p.9] This is identical to any financial market; the distinguishing factor of the money market is that it provides for only short-term cash requirements. The market will always, without fail, be required because the needs of long cash and short cash market participants are never completely synchronized. The participants in the market are many and varied, and large numbers of them are both borrowers and lenders at the same time. They include:

· the sovereign authority, including the central government (“Treasury”),

· as well as government agencies and the central bank or reserve bank;

· financial institutions such as the large integrated investment banks,

· commercial banks, mortgage institutions, insurance companies, and

· finance companies;

· corporations of all types;

· individual private investors, such as high net-worth individuals and

· small savers;

· intermediaries such as money brokers, banking institutions, etc.;

· infrastructure of the marketplace, such as derivatives exchanges.

The money market is traditionally defined as the market for financial assets that have original maturities of one year or less. In essence, it is the market for short-term debt instruments. Financial assets traded in this market include such instruments as U.S. Treasury bills, commercial paper, some medium-term notes, bankers acceptances, federal agency discount paper, most certificates of deposit, repurchase agreements, floating-rate agreements, and federal funds. The scope of the money market has expanded in recent years to include securitized products such mortgage-backed and asset-backed securities with short average lives. These securities, along with the derivative contracts associated with them, are the subject of this study.

The workings of the money market are largely invisible to the average retail investor. The reason is that the money market is the province of relatively large financial institutions and corporations. Namely, large borrowers (e.g., U.S. Treasury, agencies, money center banks, etc.) seeking short-term funding as well as large institutional investors with excess cash willing to supply funds short-term. Typically, the only contact retail investors have with the money market is through money market mutual funds, known as unit trusts in the United Kingdom and Europe.

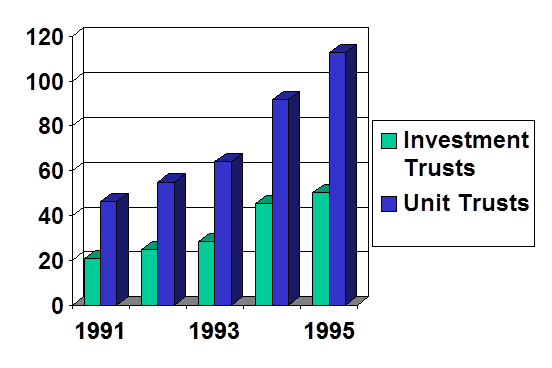

Money market mutual funds are mutual funds that invest only in money market instruments. There are three types of money market funds: (1) general money market funds, which invest in wide variety of short-term debt products; (2) U.S. government short-term funds, which invest only in U.S. Treasury bills or U.S. government agencies; and (3) short-term municipal funds. Money market mutual funds are a popular investment vehicle for retail investors seeking a safe place to park excess cash. [5, p.20] In Europe, unit trusts are well-established investment vehicles for retail savers; a number of these invest in short-term assets and thus are termed money market unit trusts. Placing funds in a unit trust is an effective means by which smaller investors can leverage off the market power of larger investors. In the UK money market, unit trusts typically invest in deposits, with a relatively small share of funds placed in money market paper such as government bills or certificates of deposit. Investors can invest in money market funds using one-off sums or save through a regular savings plan.

A money market exists in virtually every country in the world, and all such markets exhibit the characteristics we describe in this study to some extent. For instance, they provide a means by which the conflicting needs of borrowers and lenders can achieve equilibrium, they act as a conduit for financing of all maturities between one day and one year, and they can be accessed by individuals, corporations, and governments alike.

In addition to national domestic markets, there is the international cross-border market illustrated by the trade in Eurocurrencies[1]. [5, p. 10] Of course, there are distinctions between individual country markets, and financial market culture will differ. For instance, the prevailing financial culture in the United States and United Kingdom is based on a secondary market in tradable financial assets, so we have a developed and liquid bond and equity market in these economies. While such an arrangement also exists in virtually all other countries, the culture in certain economies such as Japan and (to a lesser extent) Germany is based more on banking relationships, with banks providing a large proportion of corporate finance. The differences across countries are not touched upon in this study; rather, it is the similarities in the type of instruments used that is highlighted.

A security is an instrument that represents ownership in an asset or debt obligation. Securities are classified as either money market securities, capital market securities, or derivative securities.

Money market securities are short-term indebtedness. By “short term” we usually imply an original maturity of one year or less. The most common money market securities are Treasury bills, commercial paper, negotiable certificates of deposit, and bankers acceptances. [6, p.44]

Treasury bills (T-bills) are short-term securities issued by the U.S. government; they have original maturities of either four weeks, three months, or six months. [6, p.44] Unlike other money market securities, T-bills carry no stated interest rate. Instead, they are sold on a discounted basis: Investors obtain a return on their investment by buying these securities for less than their face value and then receiving the face value at maturity. T-Bills are sold in $10,000 denominations; that is, the T-Bill has a face value of $10,000.

Commercial paper is a promissory note—a written promise to pay—issued by a large, creditworthy corporation. These securities have original maturities ranging from one day to 270 days and usually trade in units of $100,000. [6, p.45] Most commercial paper is backed by bank lines of credit, which means that a bank is standing by ready to pay the obligation if the issuer is unable to. Commercial paper may be either interest – bearing or sold on a discounted basis.

Certificates of deposit (CDs) are written promises by a bank to pay a depositor. Nowadays they have original maturities from six months to three years. [6, p.45] Negotiable certificates of deposit are CDs issued by large commercial banks that can be bought and sold among investors. Negotiable CDs typically have original maturities between one month and one year and are sold in denominations of $100,000 or more. Negotiable certificates of deposit are sold to investors at their face value and carry a fixed interest rate. On the maturity date, the investor is repaid the amount borrowed, plus interest.

Eurodollar certificates of deposit are CDs issued by foreign branches of U.S. banks, and Yankee certificates of deposit are CDs issued by foreign banks located in the United States. [6, p.45] Both Eurodollar CDs and Yankee CDs are denominated in U.S. dollars. In other words, interest payments and the repayment of principal are both in U.S. dollars.

Bankers’ acceptances are short-term loans, usually to importers and exporters, made by banks to finance specific transactions. An acceptance is created when a draft (a promise to pay) is written by a bank’s customer and the bank “accepts” it, promising to pay. [6, p.46] The bank’s acceptance of the draft is a promise to pay the face amount of the draft to whoever presents it for payment. The bank’s customer then uses the draft to finance a transaction, giving this draft to her supplier in exchange for goods. Since acceptances arise from specific transactions, they are available in a wide variety of principal amounts. Typically, bankers’ acceptances have maturities of less than 180 days. Bankers’ acceptances are sold at a discount from their face value, and the face value is paid at maturity. Since acceptances are backed by both the issuing bank and the purchaser of goods, the likelihood of default is very small.

Money market securities are backed solely by the issuer’s ability to pay. With money market securities, there is no collateral; that is, no item of value (such as real estate) is designated by the issuer to ensure repayment. The investor relies primarily on the reputation and repayment history of the issuer in expecting that he or she will be repaid.

Markets in the United States [6, p.53-57]:

1. Equity Markets

In the United States, there are two national stock exchanges: (1) the New York Stock Exchange (NYSE), commonly called the “Big Board,” and (2) the American Stock Exchange (AMEX or ASE), also called the “Curb.” National stock exchanges trade stocks of not only U.S. corporations but also non-U.S. corporations.

2. Stock Exchanges

The regional stock exchanges compete with the NYSE for the execution of smaller trades.

3. OTC Market

The OTC market is called the market for unlisted stocks. As explained previously, technically while there are listing requirements for exchanges, there are also listing requirements for the Nasdaq National and Small Capitalization OTC markets. There are three parts to the OTC market: two under the aegis of NASD (the Nasdaq markets) and a third market for truly unlisted stocks, the non-Nasdaq OTC markets.

4. Stock Market Indicators

The most commonly quoted stock market indicator is the Dow Jones Industrial Average (DJIA). Other stock market indicators cited in the financial press are the Standard & Poor’s 500 Composite (S&P 500), the New York Stock Exchange Composite Index (NYSE Composite), the Nasdaq Composite Index, and the Value Line Composite Average (VLCA).

5. Bond Markets

The bond trading that does take place on exchanges consists primarily of small orders, whereas bond trading in the OTC market is for larger—sometimes huge—blocks of bonds, purchased by institutional investors. The three broad-based bond market indexes most commonly used by institutional investors are the Lehman Brothers U.S. Aggregate Index, the Salomon Smith Barney (SSB) Broad Investment- Grade Bond Index (BIG), and the Merrill Lynch Domestic Market Index.

Похожие работы

... of British banks based in other cities of the world. Conclusions. 1. Although historically the heart of the financial services sector in Britain was located in the “Square Mile” of the City of London, and this is broadly the case now, financial institutions have moved outside the area all over the country. 2. The City of London is concentration of British financial power which makes London ...

... . It has fallen with criticism upon globalization, capitalism, bankers and the authorities. Modern form of winning virtually all the capitalist world can surely be called financial capitalism. This primarily refers to the role that global finance and they created the global financial markets play in today's world order. “It is not simply world crisis. It is crisis at globalization conditions, it ...

... define globalization in a dissimilar way, but no matter how it is described, globalization will drive us toward something innovate and unexplored, which we will have to face and deal with. 2. Globalization and Hospitality Industry The hospitality industry is by nature an international one. As international trade and business expand, there is little question but that international linkage ...

... OF GEORGIA JSC – Valuation (Refer to Annex 1) Valuation Limits True Value (GEL mln.) True Value/Market Cap. Low 50.8 3.3 High 68.6 4.4 4.3 Human-Resource Development in the Private Sector 4.3.1 Business Schools/Universities European School of Management (ESM). Data Sheet. European School of Management ESM-Tbilisi 40, Vazha ...

0 комментариев