1) What is business

2) International business

3) What is a bank

4) Companies

5) Product, Market and Market Relation

6) Finance

7) Accounting & Auditing

8) Modern Means of Business Communication

1) What is business

Business is a word which is commonly used in many different languages. But exactly what does it mean? The concepts and activities of business have increased in modern times. Traditionally, business simply meant exchange or trade for things people wanted or needed. Today it has a more technical definition. One definition of business is the production, distribution and sale of goods and services for a profit. To examine this definition, we will look at its various parts.

First, production is the creation of services or the changing of materials into products. One example is the conversion of iron ore into metal car parts. Next these products need to be moved from the factory to the marketplace. This is known as distribution, A car might be moved from a factory in Detroit to a car dealership in Miami.

Third is the sale of goods and services. Sale is the exchange of a product or service for money. A car is sold to someone in exchange for money. Goods are products which people either need or want, for example, cars can be classified as goods. Services, on the other hand, are activities which a person or group performs for another person or organization. For instance, an auto mechanic performs a service when he repairs a car. A doctor also performs a service by taking care of people when they are sick.

Business, then is a combination of all these activities: production, distribution and sale. However, there is one other part important factor. This factor is the creation of profit or economic surplus. A major goal in the functioning of an American business company is making a profit. Profit is the money that remains after all the expenses are paid. Creating an economic surplus or profit is, therefore, a primary goal of business activity.

2) International business

International business includes all business transactions that involve two or more countries. Such business relationships may be private or governmental.

There are three primary motivations for firms to pursue international business: to expand sales, to acquire resources, and to diversity sources of sales and supplies.

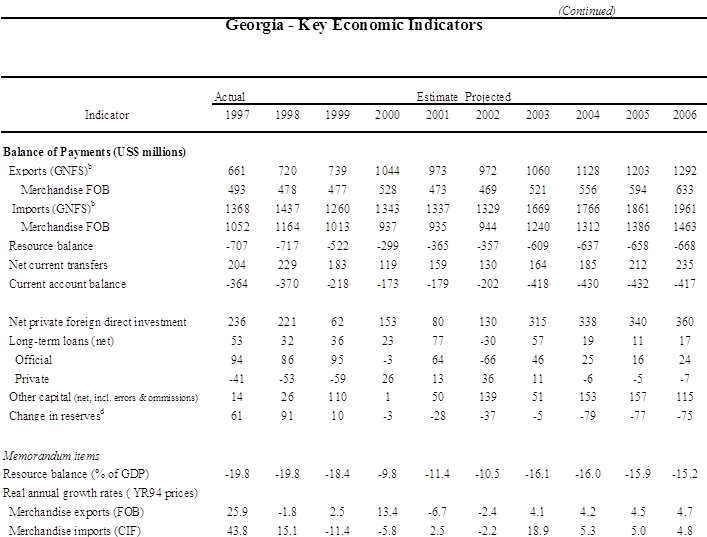

The concept of international business includes the balance of trade (the relationship between exports and imports) and balance of payments (the difference between inward and outward cash flows).

A company can engage in international business through various means, including exporting and/or importing of merchandise and services, direct and portfolio investments, and strategic alliances with other companies.

Merchandise exports are tangible goods sent out of a country; merchandise imports are tangible goods brought in. Since these goods visibly leave and enter they are sometimes referred to as visible exports and imports.

Service exports and imports are international earnings other than those derived from goods sent to another country. Receipt of these earnings is considered a service export, whereas payment is considered a service import. Services are also referred to as invisibles. International business comprises many different types of services: travel, tourism, and transportation; performance of activities abroad; use of assets from abroad.

Foreign investment is the ownership of property abroad. Direct investment is a subset of foreign investment that takes place when control follows the investment. When two or more organizations share in the ownership of a direct investment, the operation is known as a joint venture.

Portfolio investment can be either debt or equity but the factor that distinguishes portfolio from direct investment is that control does not follow this kind of investment.

3) What is a bank

A bank is a safe place to keep money. It's also much more than that. People save money in banks, banks have money to lend. Loans to people help them buy things. Loans to business help them buy, build and expand, and keep people working. These loans help the country's economy in making, distribution and use of our wealth.

Early banks were little more than moneychangers, exchanging coins and bullions from one form to another for a fee.

The way in which a bank is organized and operates is determined by its objectives. A bank may not necessarily be in business to make a profit.

There are different types of banks but their names may vary from one country to another.

Central banks such as the National Bank (Ukraine), the Bank of England (UK) or the Federal Reserve System (US) look after the governments finance and monetary policy and are responsible for issuing banknotes.

Commercial banks deal directly with the public. The aim of commercial banks is to earn profit.

A commercial bank provides a wide variety of services. There are three main functions of banking:

- deposits

- payments

- credits

These three functions are the bases of the services by banks. They make it possible for banks to generate profits and to achieve their operating aims:

- opening savings and current accounts

- offering credit services to customers: personal loans and different credit cards

- providing their customers travelling abroad with foreign currencies, travelling checks

- investment advice: banks open ways to find and invest large amount of money

- providing brokerage services

- offering a wide range of trust services for individuals and businesses.

Merchant banks don’t deal with the public. They provide services for companies.

Investment banks are firms that control the issue of new secrities (shares and bonds).

Savings banks are financial institutions in providing services such as savings accounts as opposed to general banking services.

4) Companies

Company is a corporate enterprise that operates as one single unit, in the success of which all the members participate. Company is made of a number of people united in an industrial or commercial enterprise. Each company works out its own policy. It is a selected, planes’ line of conduct in the light of which decisions are made and co-ordination of work achieved. There is a difference between a corporation, a sole trader and a partnership. The principle difference is that a sale trader end a partnership are not corporations but limited companies are. A corporation is a company that is publicly registered and legally separated from its owners. It means that the corporation stays in existence even after the death of any of its owners. An incorporated company is a legal person in its own right, able to own property. Limited Liability Company is a joint-stock company, the financial liability of whose members is limited by law. An unlimited company is one in which the liability of the members is not limited in any way. A registered company is the most common type of company. A company may be registered either as a public limited company or a private company. Private Limited Company is a limited company, which must not invite the public to subscribe for its shares or debentures, and does not allow its members to transfer their shares without the agreement of the other shareholders. It must have at least two but usually not more than fifty members. Public Limited Company is a limited company, which can offer its shares and debentures to the public; there is normally no limit to the right of its members to transfer their shares to other persons. There is no limit to the total number of members except that there must be at least seven. A public limited company must have a name ending with the initials "Pic" and have an authorized share capital. The regulation of such companies is stricter than of private companies. Most public companies are converted from private companies, under the registration procedure laid down in the Companies Act. Subsidiary Company is a company of which more than half the share-capital is owned by another company, called either a holding company or a parent company. The subsidiaries of the same parent or holding company are said to be affiliates. Many well-known companies are multinationals, these are companies which operate in a number of countries. A joint-stock company is a company in which the members pool their stock, trading on the basis of their joint stock. People in a company, its employees hold different positions. The relationship between those employees with different positions makes organization structure. At present most firms are divided into three major parts: capital (shareholders), management and labor. Let us take a typical company. There is a director who is a senior manager. He sits on the Board under the authority of the President. The Board decides what company policy and expenditure must be. The chief executive officer (CED) is the link between the Board and senior management. As for the middle managers, they run departments of a firm. They account to senior management for their area of work done. There is a difference between executive directors and non-executive ones. The directors, who run their firm on day-to-day basis are called executive directors. Those who sit on the Board and do not run the firm directly are called non-executive directors. In modern American English they use also the term inside directors for executive and outside directors for non-executive ones.

5) Product, Market and Market Relation

Product is everything that one receives in exchange. Some products are tangible and satisfy individual desires, while others are intangible but also important in satisfying individual interests. Products are divided into two classes: goods and services. For example, a hamburger is a good, while a doctor's examination is a service. When you buy an automobile, you are purchasing a good. When you have someone adjust a carburetor, however, you are purchasing a service. So good is a real, physical, tangible thing that produced and consumed. A service is an intangible attribute that involves selling help and advice, or delivering goods for customers.

The definition of the term product is based on the concept of a market. The market is an extension of the ancient idea of a market as a place where people gather to buy and sell goods. In former days part of a town was kept as the marketplace, and people would travel many kilometers on special market days in order to buy and sell various commodities. Today, however, markets such as the gold market or the cotton market do not need to have any fixed geographical location. Such a market is a set of transactions in which the transactions for this commodity among different individuals and firms are related.

Some people come to a market because they want to buy (demanders), others come because they want to sell (suppliers). A market is created when those who willingly supply a good exchange with those who desire to use, control or consume a good or service.

Supply and demand are the twin factors which determine the price in any market. Supply is the quantity of goods or services sellers will offer for sale at different prices at a particular time and place. Demand is the total amount of a type of goods or services that people or companies buy at a particular time and place.

Markets reallocate commodities from supplies to demanders. What if suppliers want to provide more than demanders want to purchase? Or, what if demanders want more than suppliers are willing to provide?

Excess supply occurs when, at a particular market price, the quality of demand. Excess demand occurs when, at a particular market price, there is more demand for something than available suppliers of it.

A market is equilibrium when the quantity that suppliers are willing to provide to the market at a specific market price is exactly equal to the quantity that demanders desire to purchase in the market at the same market price.

The importance of equilibrium is that the equilibrium relative price is the only price at which the interests of demanders happen to coincide precisely with the interests of the suppliers.

6) Finance

Finance is the function in a business that is responsible for obtaining funds, managing funds, within if and controlling them. Most organizations have finance managers or financial departments in charge of financial operations. Financial management performs the following finance functions.

Planning Collecting funds (Credit management)

Budgeting Auditing

Obtaining funds Managing taxes

Controlling funds Advising top management on financial matters

So, the main task of finance manager is to obtain money, then plan it, use and control money effectively.

You must be sure that without a carefully calculated financial plan and budget the firm has little chance for success.

Obtaining funds - is a very important finance function, because the amount of money needed for various time periods and its sources are fundamental questions in sound financial management.

Financial control means that the revenues, costs and expenses are periodically reviewed and compared with projection.

Credit management gives a firm chance to earn money having an interest on credits and loans given.

Managing taxes means tax implications of various financial transactions.

And finally, financial people help management in decision making. All this functions depend greatly on the information provided by the accounting statements.

7) Accounting & Auditing

Accounting is often called the language of business. It is used in the business world to describe the transactions entered into by all kinds of organizations. Accounting is the recording, classifying, summerising and interpreting of financial events and transactions to provide management and other interested parties, (owners, investors, bankers, lawyers and accountants) with the information they need to make better decisions.

After recording the transactions into the journal they are classified into groups (accounts) that have common characteristics.

There are 5 accounts in accounting: assets, liabilities, owner's equity (capital), revenues and expenses. The double-entry system divides each page into two halves. The left-hand side, value, received, is called a debit side, the right-hand side, value parted with, the credit side.

Auditing is an accounting function that involves the review and evaluation of the financial records and financial position of a company. Audits' are performed by highly qualified accountants (auditors) and are ordered by the management of the company or by state authorities (revision and control). Not so many years ago an audit suggested that a company had financial difficulties or some irregularities in the records. At present, audits are a normal and regular part of business practice

There are two types of auditing: internal and independent.

Internal auditing is a system of internal control which provides accounting controls; against errors and misappropriations. Many companies employ their own accountants to maintain the internal audit.

Independent auditing is done by certified accountants who are not employees of the organization whose books they examine. Independent auditors review the business's operating activities: they examine financial statements, the accounting records and other business papers to determine the accuracy and completeness of the records.

The auditor's judgement or opinion on the fairness of the records is written in a document sent to the client upon completion of the audit. It consists of a letter addressed to the-client that consists of a scope paragraph j(a list of documents that the auditor has examined and the standards that were used for the audit) and an opinion paragraph (the auditor's opinions).

Auditors can help the business set up a reliable accounting system.

8) Modern Means of Business Communication

People have always tried to convey information. Now, they send letters and documents by post, by fax, by computer and they make phone calls from home or the office or, thanks to mobile phones, from wherever they happen to be.

The list of services, thanks to advanced technology, is long and presumably will grow. People can phone and fax from trains and planes. They can buy things, carry out financial transactions, get information - all without leaving their chairs.

This is the global information age. The worldwide computer network known as the Internet connects millions of people worldwide. It connects many computer networks and uses common addressing system.

The most popular Internet service is e-mail. Using e-mail, you can send messages to anyone with an internet account. Most businesses today have electronic address because e-mail provides cheap and rapid communication.

Since the mid-1990s electronic commerce has become one of the most rapidly growing retail sectors involving the use of computer telecommunication networks for maintaining business relationships and selling information, services and commodities. Although e-commerce usually refers only to the trading of goods and services over the Internet, it actually includes broader economic activity such as business-to-consumer and business-to-business commerce as well as internal organizational transactions that support these activities.

A new form of collaboration known as a virtual company is flourishing now. This type of company is actually- a network of firms, each performing some of the processes needed to manufacture a product or deliver a service.

E-mail is cheap and easy to use. E-mail is the transmission and distribution of information through personal computers linked to the telephone system, which allows subscribers to send a message directly to another subscriber that will appear in their electronic mail box.

Computer use continues to grow and develop in all spheres of our life. Its applications have had a great impact on the business world. Computers have helped society by increasing productivity and simplifying many services, such as checking, credit cards, and telephone service.

Похожие работы

... , Conclusion and Appendix. Kazakh State University of International Relations and World Languages named after Abylay Khan Chair of LexicologyE. Gadyukova Group 406 English Teaching DepartmentThe Linguistic Background of Business Correspondence(Diploma Paper)Scientific Supervisor Associated Professor Bulatova S. M.Almaty, 2001 Part I The Basic Forms Of Communication As David Glass is well aware, ...

... insurance, no disability insurance, no sick leave, no vacation pay, and so on. These benefits may add up to 30% or more of a worker’s income. 6. Limited growth. If the owner becomes incapacitated, the business often comes to a standstill. Furthermore, a sole proprietorship relies on its owner for most of its funding. Therefore expansion often is slow and there are serious limits to how much one ...

... organization, whose membership at its peak included 109 National Tourist Organizations (NTOs) and 88 Associate Members, among them private and public groups. As tourism grew and became an integral part of the fabric of modern life, its international dimension increased and national governments started to play an increasingly important role-their activities covering the whole spectrum from ...

... OF GEORGIA JSC – Valuation (Refer to Annex 1) Valuation Limits True Value (GEL mln.) True Value/Market Cap. Low 50.8 3.3 High 68.6 4.4 4.3 Human-Resource Development in the Private Sector 4.3.1 Business Schools/Universities European School of Management (ESM). Data Sheet. European School of Management ESM-Tbilisi 40, Vazha ...

0 комментариев