Навигация

The estimation of efficiency of the innovative project in public health services

3. The estimation of efficiency of the innovative project in public health services

3.1 Estimation of efficiency of the innovative project by a standard technique

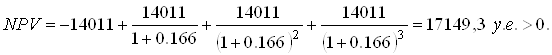

1) Calculation of factor of the pure resulted cost (NPV) For application of a standard technique of a case of the innovative project considered in the present degree work, all basic numerical data will undertake from point 3.2 of the present work. So the forecast, let us assume, becomes that the investment (IC) will generate within 3 years, revenues at a rate of CF1, CF2, CF.... The general saved up size of the discounted incomes (PV) (Present Value) and the pure resulted cost (NPV) (Net Present Value) Pays off.

![]()

Here n - quantity of the periods of time on which the investment is made, r - norm of profitableness (profitableness) from an investment. It is known that if: NPV> 0 the project should be accepted; NPV <0 the project should be rejected; NPV = 0, the project not profitable and not the unprofitable. For our project

Here and more low in work we will believe that 1 c.u. = 1$. We will notice also, what at the moment of 01.04.04 Central Bank rate of the Russian Federation of the American dollar made 28 rbl. 13 copeck Here in the first composed number 14011 of c.u. with a minus corresponds to the full cost price of the project, r=0,166, or, what the same, r=16,6 %? Level of profitability (profitableness) of the project. For our project the settlement size is more than zero, the project profitable means. 2) calculation of an index of profitability of investments (PI) Pays off a profitability index (Profitability Index) (PI) under the formula:

PI = ∑k [Pk / (1 + r)k] / IC,

Let's remind that if: PI> 1 the project should be accepted; PI <1 the project should be rejected; PI = 1, the project neither profitable, nor unprofitable. For our project it is had:

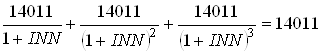

Here 8721 c.u.? Net profit size. In brackets three composed as we investigate the project within three years? 2005, 2006 and 2007 whereas we begin project realisation in 2004. For the considered project this size is more than unit, hence, the project profitable. 3) calculation of internal rate of return or norm of profitability of the investment (IRR) (Internal Rate of Return) (IRR) understand value of factor of discounting As internal rate of return or norm of profitability of the investment r at which NPV the project it is equal to zero: IRR = r, at which NPV = f (r) = 0.

.

.

Where CFj - an entrance monetary stream during j th period, INV - value of the investment. Strictly speaking, this factor dismisses not so much, how many the equation, having solved which, we will find the norm of profitableness INN is minimum necessary for realisation of the project. For our project it is had a following equation:. We will notice that in the left member of equation three composed owing to that consideration is conducted for three years. A trial and error method we find that for performance of following equality it is necessary, that approximate equality was observed. It means that the norm of profitableness of 8,1 % whereas from following point it will be visible that norm of profitableness of our project of 16,6 % is necessary for a project recoupment. It means that it is necessary to recognise the project profitable. We will draw conclusions by results of calculations of the basic factors of model under the decision on acceptance or a project deviation is accepted after consideration of values resulted above factors. As we saw, all these factors have yielded that result that the project profitable and it should be accepted to realisation.

3.2 Estimation of efficiency of the innovative project by an offered technique

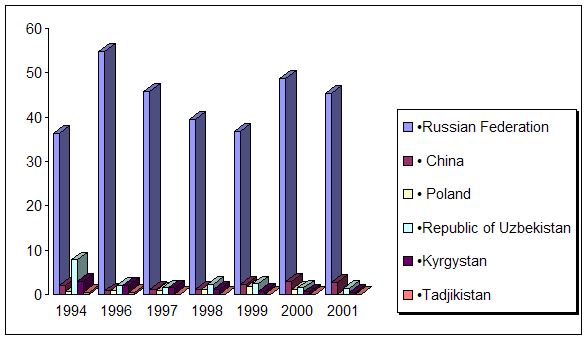

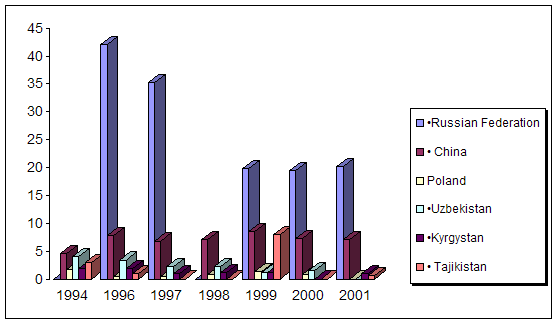

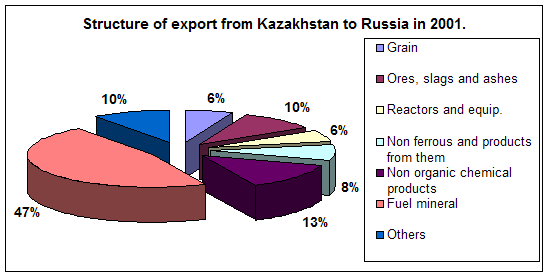

Industrial competitive advantages. For device manufacturing? The biotest? Components will be used inexpensive, not scarce, широкодоступные, but at the same time qualitative, basically import manufacture. In this connection the device will have high consumer properties at the low cost price. A market estimation. The market of the medical equipment in Russia is not sated enough by the equipment of the given direction [23] whereas the developed device has no strong contenders both on Russian, and in the foreign market. It promotes fast advancement of the device on the market of Russia and the near abroad. Changes in the given market can occur under the influence of following external factors: - occurring in the currency market - preference of consumers As it is necessary to pay attention of change to the internal factors influencing a condition of the given market: - a competition; - change of internal structure of participants of the market. All it leads to constant changes in the given market that and as consequence constant improvement and expansion of assortment of production, and as to expansion of a variety of the services given together with the offered goods constantly promotes qualitative improvement of structure of participants. Novosibirsk scientists carry out statistical researches, applicable for the marketing analysis of the market of medical services [24]. On the spent statistical researches the schedule of distribution by consumers of given production on categories has been constructed:

15 % - the Doctors who are engaged in individual activity of 30 % - the Medical institutions applying non-standard methods of diagnostics and treatment of 55 % - the Medical institutions rendering additional paid services of a Fig. 3.1.? Distribution of consumers on categories From the resulted data we see, what more than half (55 %) consumers of medical services address in the establishments rendering additional paid services? But these establishments just also are potential buyers of production for which the investment project [61] is developed. That fact is interesting that in the Russian market at present there are all some competitors [25]: * Peterlink Electronics. It is the German company, she offers very high-class devices working only complete with the COMPUTER and the software. Production of this company has no such necessary property as compactness and mobility. The firm offers completely equipped offices intended only for work with this device. Completely equipped office costs approximately $20000. Such expenses are presumed only by the provided medical institution. * Kindling. It too the company from Germany. About it there is an information small amount. Devices of this company are delivered and work both from the COMPUTER and without the COMPUTER but as have no property of compactness and mobility. The complete set of the equipment of the given company costs approximately from $5000 to $6000 depending on a complete set. * Start-1. It is the Russian firm. Makes complexes both from the COMPUTER, and without the COMPUTER. It is known that the complex without the COMPUTER costs approximately $1400. The basic advantage of all three listed companies consists that in their devices there is a quantity of additional functions, but this advantage is not the main thing. Lacks of all three companies consist that: - Devices do not have properties of compactness, mobility, and they are difficult in circulation; - the high prices for complexes. Advantages of our device are its such properties as: mobility, compactness, possibility to work both in stationary, and in field conditions, possibility to work both complete with the COMPUTER, and without the COMPUTER, very low price at quality not conceding to competitors, but in our device are collected only the basic functions which are the most necessary. A lack of the given device is absence in it of additional functions available for competitors. A company lack is its not so wide popularity on the given segment of the market, but this lack constantly decreases. The table in which the advantages set forth above and lacks are shown is more low resulted.

Let's notice that at the moment of April, 1st, 2004 1 American dollar on a Central Bank rate of the Russian Federation made 28 rbl. 15 copeck Of the table it is visible that the considered device has big advantages in comparison with the competitive. The goods of competitors are calculated basically on a narrow circle of the consumers having their possibility to buy, and many have such possibility far not. At the same time the considered device has low enough price at the basic requirements not conceding to competitors, and in some parametres them even surpasses. Demand forecasting. For the forecast we will take advantage of mathematical modelling of demand for the developed device? The biotest?. The essence of an applied mathematical method consists in extrapolation of the statistical data about presence of similar devices in medical institutions of a city and area for 2002-2004 on volume of demand for the considered device in 2005. For extrapolation carrying out it is necessary to calculate a trend line. Calculation of a straight line of demand. The general equation of a straight line [8]

y=a0+a1t,

Where at? The predicted volume of demand, t? Time moment (year, day, month, etc. in which us the demand volume), a0 and a1 interests? Unknown factors of a straight line of demand subject to calculation. Two unknown person of factor of a straight line of demand we will find from two linear equations

na0+a1åt=åy,(3.5)

a0åt+a1åt2=å yt.(3.6)

Here п? Quantity of the considered moments of time (for example, as in our case, three years). At application of the described model of forecasting of demand for a developed product, we will take advantage of results of own researches which consisted in data gathering about presence of the devices realising a method of Follja in medical institutions of Novosibirsk and the Novosibirsk region. The idea of the forecast of demand consisted in that, having the information on presence similar developed in the present work of devices, to assume that on the offered device demand will develop under the same mathematical laws. For drawing up of the equations of the predicting we will take advantage of the following table in which results of telephone surveys of assistants to head physicians on economy of various medical institutions of a city of Novosibirsk and the Novosibirsk region are brought:

From the schedule it is visible that in 2005 theoretical volume of demand for the device? The biotest? In Novosibirsk and the Novosibirsk region will make 600 units of production. Working out of the organizational project of manufacture. 5 day working week and 8 hour working day necessary quantity the person Is supposed, occupied on an industrial site (the basic workers) makes 2 persons. Specificity of the given work assumes, that the employees occupied on an industrial site possess high qualification in radio electronics and installation of electronic components. The control system of all firm is under construction by a principle of linear organizational structure which allows to conduct an effective control behind firm work as a whole. More low in the table calculation of annual fund з/п heads, experts and employees is resulted.

Capacity calculation. For normal work of firm the one-replaceable operating mode with 8 hour working day is recommended. Duration of working week of 5 days. It is necessary to notice that duration of work of firm during the day makes 9 hours. Here it is necessary to include an hourly break on rest in work. The break to be put after first 4 business hours. Taking into account what the total quantity of days for holidays, target, within a year makes holidays of an order of 112 days, we receive, what quantity of the working days in a year of 365 days? 112 days off = 253 working days. From here the fund of a usage time of the equipment for 8 hour changes taking into account time for service makes 1820 hours. Knowing fund of an operating time of the equipment, we will define annual throughput. 2 persons work for us. The average norm of time for assemblage of one device makes 6 hours. Hence capacity (throughput) in a year makes: Qгод. = (1820:6) *2=607 piece/year As it has already been noted, the predicted sales volume makes 600 pieces / year. Hence, the factor of loading of the equipment makes: Кзагр. = 600/607=0.99, i.e. 99 %. It is necessary to note risk which should be considered in offered model. As it has been told above, a core of offered model of an estimation of efficiency of innovative projects is demand forecasting. If real demand differs from predicted throughput of assembly shop can be regulated a multiplier corresponding to quantity of the personnel. So, if real demand will make, for example, 900 pieces throughput will need to be counted not under formula Qгод. = (1820:6) *2=607 piece/year, and under formula Qгод. = (1820:6) *3=910 sht/year that corresponds to that workers should be 3, instead of 2 persons. It means that the offered model is steady against risk of change of demand as it will be easy to be arranged by quantity of the personnel under real demand. Calculation of volume of investments. For calculation of necessary volume of financing it is necessary to define structure of expenses which are necessary for firm work. They look as follows: 1) Expenses for premise rent for the first month are defined from calculation that rent cost for 1 square metre of a premise a year makes 300 c.u., we receive rent cost: Саренды = 300 * (24+30*0.15)/12 = 712 u.e./mes As output makes 15 % from total amount of manufacture of all enterprise that from rent not industrial premises is taken 15 %. 2) Expenses for the equipment and stock.

In this table, as well as further, one standard unit corresponds to 1 US dollar, i.e. approximately 30 roubles. 3) expenses for initial purchases of accessories at the rate on 1 month of work. For definition of expenses we believe that every month in firm the identical number of devices equal 1/12 of part of annual release is issued. The annual volume of release is accepted 600 units. Hence in a month 50 devices will be issued. Expenses for purchase of accessories for each device approximately are equal 38 c.u. From here is received that expenses for creation of stocks of materials for work within a month are equal 38*50=1900 c.u. 4) Initial publicity expenses undertake with such calculation that it is necessary to dispatch a direkt-mail at least all 1/3 of Moscow medical institutions fair brochures. It is supposed to spend for it about 500 c.u.

The analysis of economic indicators. For carrying out of the given analysis it is necessary to make a report of the basic economic indicators. Them concern such, as: profit (total and pure); profitability of production; profitability of funds; the full cost price; labour input; the predicted price for production; a critical sales volume and release; efficiency of capital investments; a time of recovery of outlay; a stock of financial durability. 1) the size of total profit on sales of the considered device within the first year of work will make 14011 c.u. provided that the predicted break-even sales level will be provided. For definition of size of net profit it is necessary to define the tax to property of the enterprise which reduces base of the taxation under the profit tax. Cost of property of the organisation develops from: - costs of rent of a building - 8550 c.u.; - costs of the equipment minus 7 % of deterioration 3400 * (1-0.07 =3162 c.u.; From here property cost makes: 8550+3162=11712 the Tax to property (2 %) makes c.u.: 11712*0.02 = 234 c.u. the Tax to the maintenance of available housing of 1.5 % from a gain 14011*0.015=210 c.u. the Tax to general educational needs of 1 % from payment fund 14994*0.01=150 c.u. the Base of the taxation under the profit tax is equal: 14011-234-210-150 = 13417 c.u. the Profit tax makes by the current moment 35 % and is equal: 13417*0.35=4696 c.u. the net profit Size makes 13417-4696=8721 c.u. Profit at the disposal of the organisation (a difference between net profit and returned investments): 8721-6512=2209 2) the Size of profitability of production makes c.u.: r = П:Т = 14011/84600*100 = 16.6 %, that is on 100 roubles of sold production are necessary 16.6 roubles of profit. 3) size of profitability of production assets: (П: (ОФ + МС) *100) where average cost of a fixed capital (ОФ) equals: ОФ=8550+3400=11950 c.u. average cost of material circulating assets (МС) is equal: МС=22800 c.u. From here the size of profitability of production assets is equal: (14011 / (11950+22800)) *100 % = 40.3 % 4) the Full cost price of production is equal 70554 c.u. 5) Labour input of let out production is equal to the sum of time spent for each unit of production on a separate workplace: Т=6 hours. 6) the predicted price for firm production is equal 141 c.u. 7) the Critical volume of a gain from sales makes 55695 c.u. at which the critical sales volume makes 395 devices. 8) efficiency of capital investments is defined as the relation of profit to capital investments (investments): Е = П / To = 8721/6512=1.34 9) the Time of recovery of outlay - size return efficiency of capital investments: Т = 1 / Е = 0.75 years or 9 months. 10) the stock of financial durability of the organisation is defined as follows: Wпрочн. = (Dmax-Dmin)/Dmax*100 %, where Dmax - the maximum revenue of production sale; Dmin - the revenue at a critical break-even sales level; Wпрочн. = (84600? 55695)/84600*100 % = 34 %. It means that there is a possibility to lower the income of sales on size of 34 % from the planned. If to speak about rate of return (20 %) it is optimum for firm, the considerable which share of sales is provided directly though all attention is concentrated to buyers with a low prosperity. Net profit, being at the command it is quite enough enterprise to pay back capital investments within the first year of work. The low norm of profitability of the sold goods will be compensated by a stable break-even sales level. Labour input of production on time allows firm to provide the demanded volume of release, not задействуя thus a considerable quantity of employees. The price for production, should draw attention of potential buyers with low level of a prosperity as it is enough low in comparison with competitive by the current moment. The critical sales volume makes 66 % from the planned. This fact allows firm to stabilise the position in the market within the first year of work even in case of struggle from outside competitors. Efficiency of capital investments is estimated in 134 %. That is after the first year of work the size of net profit, firm being at the command will make 134 % from the enclosed capital. The small time of recovery of outlay of the capital allows firm already by the end of the first year of work to get the profit going on development of the organisation, instead of return of the enclosed means. The stock of financial durability of the company makes 34 % that allows the company to work in the conditions of a competition without losses. That is there is a possibility to lower the planned income of sales on size of 34 % from the planned. On the basis of the considered indicators it is possible to draw a conclusion that the project is effective for following reasons: 1) Low profit, but stable sales; 2) the Low prices for production; 3) Low level of a critical sales volume in comparison with the planned; 4) High efficiency of capital investments; 5) the Short time of recovery of outlay of the capital; 6) the Sufficient stock of financial durability. All it will allow firm to occupy stable position in the market within the first year of work and will provide a break-even sales volume.

Похожие работы

... . The advertising idea is defined. Advertising strategy is however insufficiently clearly stated. We will take advantage of the given reserve for increase of efficiency of an advertising campaign of Open Company "Натали", i. e. we will develop advertising strategy. 3.3 Use of methods of optimization in advertising activity One of optimisation methods in advertising activity is use of ...

... her behavior, beliefs, or perceptions. The manner in which a particular individual classifies cognitions in order to impose order has been termed cognitive style. 7. Tests and Measurements Many fields of psychology use tests and measurement devices. The best-known psychological tool is intelligence testing. Since the early 1900s psychologists have been measuring intelligence—or, more accurately ...

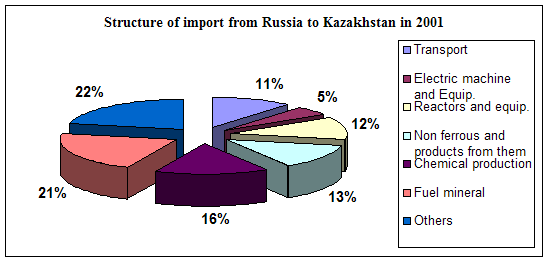

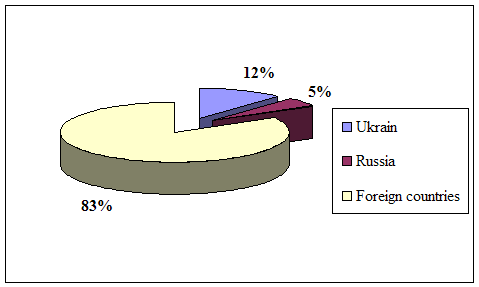

... course of republic. A complex of the reasons conditions and factors having not tactical, but basic essence and long-time character stipulates it. Today common balance of mutual relation between Kazakhstan and Russia has positive character, as consider each other as the strategic partners and it establishes the important premise for their mutual cooperating in the field of policy, economy, ...

... a request for interested parties (Expression of Interest /Needs) to suggest ideas for activities that could be included. II.5.2 Implementation Modalities (“Types of actions") The “Quality of Life and Management of Living Resources” programme is implemented through the following types of actions: 1. Shared-cost actions, excluding “Support for access to research infrastructures”9 2. Concerted ...

0 комментариев