Навигация

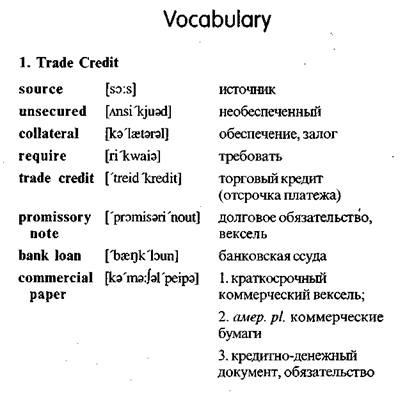

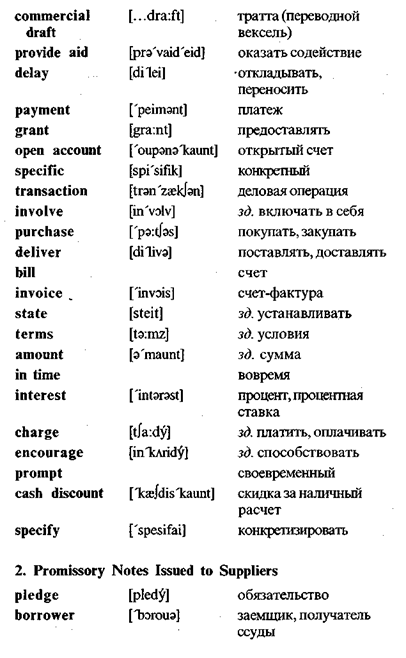

1. TRADE CREDIT

Wholesalers may provide financial aid to retailers by allowing them thirty to sixty days (or more) in which to pay for merchandise. This delayed payment, which may also be granted by manufacturers, is a form of credit known as trade credit or the open account. More specifically, trade credit is a payment delay that a supplier grants to its customers.

Between 80 and 90 percent of all transactions between businesses involve some trade credit. Typically, the purchased goods are delivered along with a bill (or invoice) that states the credit terms. If the amount is paid on time, no interest is generally charged. In fact, the seller may offer a cash discount to encour-. age prompt payment. The terms of a cash discount are specified on the invoice.

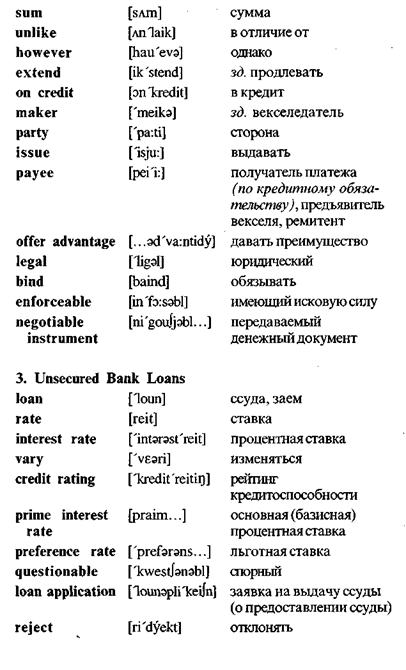

2. PROMISSORY NOTES ISSUED TO SUPPLIERS

A promissory note is a written pledge by a borrower to pay a certain sum of money to a creditor at a specified future date. Unlike trade credit, however, promissory notes usually require the borrower to pay interest. Although repayment periods may extend to one year, most promissory notes specify 60 to 180 days. The customer buying on credit is called the maker and is the party that

issues the note. The business selling the merchandise on credit is called the payee.

A promissory note offers two important advantages to the firm extending the credit. First, a promissory note are negotiable instruments that can be sold when the money is needed immediately.

3. UNSECURED BANK LOANS

Commercial banks offer unsecured short-term loans to their customers at interest rates that vary with each borrower's credit rating. The prime interest rate (sometimes called the preference rate) is the lowest rate charged by a bank for a short-term loan. This lowest rate is generally reserved for large corporations with excellent credit ratings. Organizations with good to high credit ratings may have to pay the prime rate plus 4 percent. Of course, if the banker feels loan repayment may be a problem, the borrower's loan application may be rejected.

Banks generally offer short-term loans through promissory notes. Promissory notes that are written to banks are similar to those discussed in the last section.

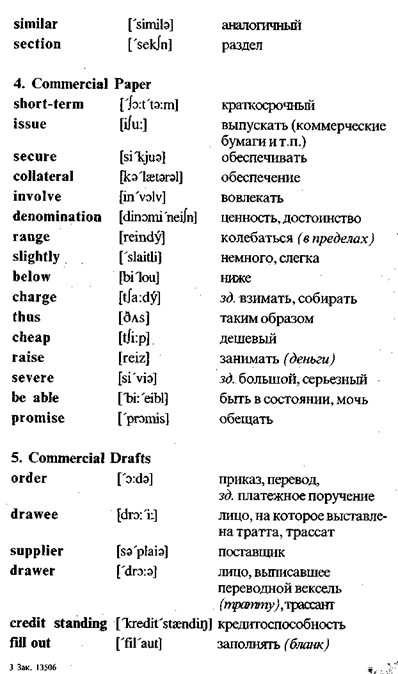

4. COMMERCIAL PAPER

A commercial paper is a short-term promissory note issued by a large corporations. A commercial paper is secured only by the reputation of the issuing firm; no collateral is involved. It is usually issued in large denominations, ranging from $5,000 to $100,000. Corporations issuing commercial papers pay interest rates slightly below those charged by commercial banks. Thus, issuing a commercial paper is cheaper than getting short-term financing from a bank.

Large firms with excellent credit reputations can quickly raise large sums of money. They may issue commercial paper totaling millions of dollars. However, a commercial paper is not without risks. If the issuing corporation later has severe financing problems, it may not be able to repay the promised amounts.

|

|

5. COMMERCIAL DRAFTS

A commercial draft is a written order requiring a customer (the drawee) to pay a specified sum of money to a supplier (the drawer) for goods or services. It is often used when the supplier is insure about the customer's credit standing.

In this case, the draft is similar to an ordinary check with one exception: The draft is filled out by the seller and not the buyer. A sight draft is a commercial draft that is payable on demand -whenever the drawer wishes to collect. A time draft is a commercial draft on which a payment date is specified. Like promissory notes, drafts are negotiable instruments that can be discounted or used as collateral for a loan.

|

|

|

|

|

|

Exercises

I. Translate into Russian.

Source; unsecured financing; promissory note; commercial draft; trade credit; loan; commercial paper; transaction; delayed payment; credit terms; pay interest; interest rate; invoice; amount; prompt payment; written pledge; sum of money; borrower; repayment period; buy on credit; deliver; provide aid; maker; payee; offer loans; credit rating; prime interest rate; questionable credit rating; large denomination; raise large sums of money; drawee; drawer; credit standing; sight draft; time draft; collateral; commercial draft.

II. Find the English equivalents.

Ссуда; давать ссуду; процент; процентная ставка; необеспеченное финансирование; покупать в кредит; условия кредита; счет-фактура; основная сумма; деловая операция; торговый кредит; долговое обязательство; коммерческая бумага; тратта (переводной вексель); условия; обеспечение (залог) ; заемщик; трассат (лицо, на которое выставлена тратта); трассант (лицо, выписавшее переводной вексель-тратту) ; кредитоспособность; тратта (вексель) на предъявителя; срочная тратта.

III. Fill in each blank with a suitable word or word combination.

1. Trade credit is a payment... that a supplier grants to its customers.

2. The invoice that's ....

3. A promissory note is a written ... by a borrower to pay a certain sum of money at a specified date.

. 4. The customer buying on credit is called ... and is the party that issues the promissory note.

5. The business selling the merchandise on credit is called ....

6. Most promissory notes are... that can be sold when money is needed immediately.

7. The prime interest rate is the lowest rate charged by a bank for... loan.

8. A commercial paper is ... issued by a large corporation.

9. A commercial paper is secured only by the ... of the issuing . firm.

10. Issuing a commercial paper is ... than getting short-term financing from a bank.

11. A commercial draft is a written... requiring a drawee to pay a specified sum of money to the ... for goods or services.

12. A sight draft is a commercial draft that is payable on ....

13. A ... is a commercial draft on which a payment date is specified. 14. Like promissory notes drafts can be used as ... for a loan.

IV. Translate into English.

1. Источники необеспеченного краткосрочного финансирования включают торговые кредиты, долговые обязательства, банковские ссуды, краткосрочные долговые обязательства (кредитно-денежные документы) и тратты (переводные векселя).

2. Торговый кредит — это отсрочка платежа, которую поставщик предоставляет своим клиентам.

3. Долговое обязательство — это письменное обязательство заемщика уплатить определенную сумму денег кредитору.

4. В отличие от торгового кредита долговые обязательства требуют, чтобы заемщик платил проценты.

5. Коммерческие банки предоставляют необеспеченные краткосрочные ссуды своим клиентам, которые меняются в зависимости от (with) кредитоспособности каждого заемщика.

6. Коммерческая бумага — это краткосрочное долговое обязательство, выпускаемое крупными корпорациями. .

7. Коммерческая бумага не имеет специального (special) обеспечения.

8. Тратта (переводной вексель) —это письменный приказ, требующий, чтобы трассат (лицо, на которое выставлена тратта) уплатил конкретную сумму денег поставщику за товары или услуги.

9. Тратта часто используется, когда поставщик не уверен в кредитоспособности клиента.

V. Answer the questions.

1. What is unsecured financing?

2. What are the sources of unsecured short-term financing?

3. What is a trade credit?

4. What is the difference between a promissory note and trade credit?

5. In what case a loan application may be rejected by a bank?

6. What is a commercial paper secured by?

7. Why issuing a commercial paper is cheaper than getting short-term financing from a bank?

8. What is a commercial draft?

9. Can commercial drafts be used as collaterals for loans?

VI. Make up a written abstract of the above text.

VII. Retell the prepared abstract.

Unit7

Accounting

1. GENERAL DEFINITION OF ACCOUNTING

Today, it is impossible to manage a business operation without accurate and timely accounting information. Managers and employees, lenders, suppliers, stockholders, and government agencies all rely on the information contained in two financial statements. These two reports — the balance sheet and the income statement — are summaries of a firm's activities during a specific time period. They represent the results of perhaps tens of thousands of transactions that have occurred during the accounting period.

Accounting is the process of systematically collecting, analyzing, and reporting financial information. The basic product that an accounting firm sells is information needed for the clients.

Many people confuse accounting with bookkeeping. Bookkeeping is a necessary part of accounting. Bookkeepers are responsible for recording (or keeping) the financial data that the accounting system processes.

The primary users of accounting information are managers. The firm's accounting system provides the information dealing with revenues, costs, accounts receivables, amounts borrowed and owed, profits, return on investment, and the like. This information can be compiled for the entire firm; for each product; for each sales territory, store, or individual salesperson; for each division or department; and generally in any way that will help those who manage the organization. Accounting information helps man-

agers plan and set goals, organize, motivate, and control. Lenders and suppliers need this accounting information to evaluate credit risks. Stockholders and potential investors need the information to evaluate soundness of investments, and government agencies need it to confirm tax liabilities, confirm payroll deductions, and approve new issues of stocks and bonds. The firm's accounting system must be able to provide all this information, in the required form.

Похожие работы

... changing his name from Maury, the name of a Bascomb, will somehow avert the disastrous fate that the Compson blood seems to bring. This overwhelming sense of an inescapable family curse will resurface many times throughout the book. Summary of June Second, 1910: This section of the book details the events of the day of Quentin's suicide, from the moment he wakes in the morning until he leaves ...

... озвончения в середине слова после безударного гласного в словах французского происхождения. Зав. кафедрой -------------------------------------------------- Экзаменационный билет по предмету ИСТОРИЯ АНГЛИЙСКОГО ЯЗЫКА И ВВЕДЕНИЕ В СПЕЦФИЛОЛОГИЮ Билет № 12 Дайте лингвистическую характеристику "Младшей Эдды". Проанализируйте общественные условия национальной жизни Англии, ...

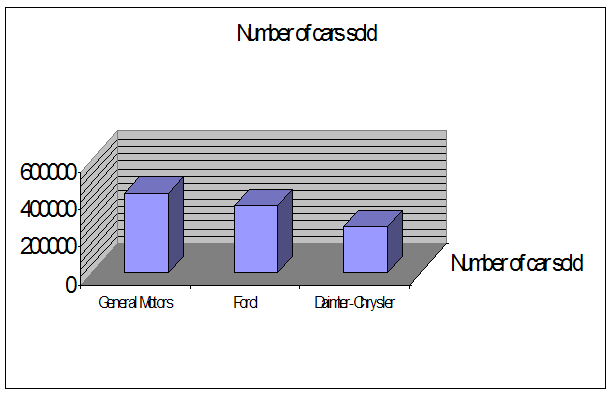

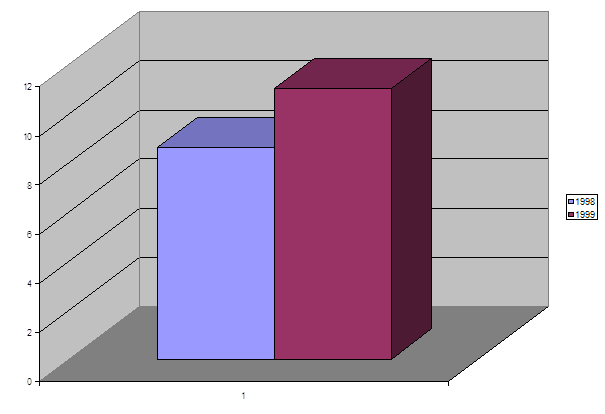

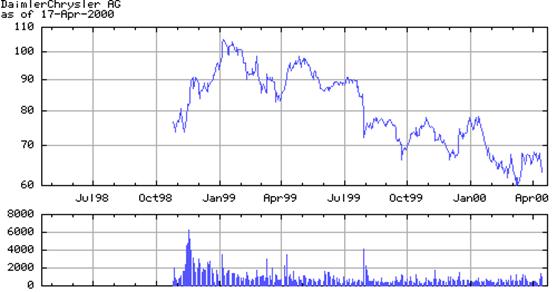

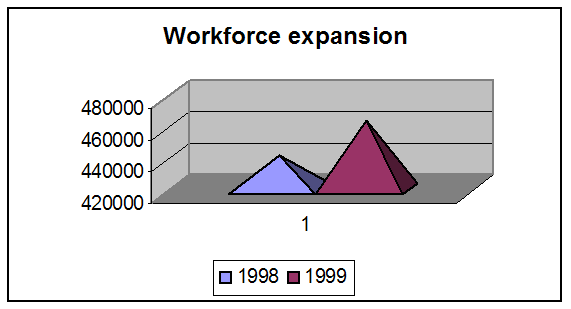

... car manufacturing world. On July 24 and July 31 of 1998, the European Commission and the Federal Trade Commission, respectively, approved the merger of Chrysler and Daimler-Benz Corporation, and appearance of Daimler-Chrysler. This merger is classified as a “horizontal merger.” In order to become the largest car-producing corporation in the world, Daimler-Chrysler has to acquire or merger ...

... правильным вариантом поведения компании для достижения эффективного долгосрочного функционирования и успешного развития является уделение повышенного внимание осуществлению анализа внешнего и внутреннего окружения. Это подразумевает проведение комплексного анализа, который может быть проведен с использованием вышеперечисленных методик, который дает достаточно ясное и объективное представление о ...

0 комментариев