Навигация

The importance of the monetary strategy for a successful start of European monetary policy

3. The importance of the monetary strategy for a successful start of European monetary policy

When price stability is defined using the principles just outlined, how should the ESCB proceed to maintain it? In achieving and maintaining price stability - the primary objective of the Treaty - the choice of monetary policy strategy is vital.

Within the ECB, a considerable amount of work on the monetary policy strategy has already been completed, building to a large extent on the substantial earlier preparatory work of the EMI. A high degree of consensus has been reached among the NCBs and within the ECB about the main outlines of the strategy - I will address some of these areas of agreement in a moment. The final decision has not yet been made. But you should be reassured that progress is being made at a good pace. I have no doubt that we will be in a position to announce the details of the ESCB's monetary policy strategy in good time, prior to the start of Stage Three.

Being a new institution, the European Central bank must be prepared to come under intense scrutiny right from the start. In particular, the international financial markets will monitor its every decision like hawks. Facing this environment in the run-up to Monetary Union, the ESCB must ensure that everything possible is done to make the launch of Stage Three as tension-free as is possible. Choosing and announcing an appropriate monetary strategy is crucial.

The monetary policy strategy is, in the first place, important for the internal decision-making process of the ESCB - how the Governing Council will decide on the appropriate monetary policy stance, given the economic environment. Above all, the ESCB strategy must lead to good - that is to say, timely and forward-looking - monetary policy decisions.

But the strategy is also of the utmost significance in communicating with audiences outside the ESCB. It should stabilise inflation expectations. The more the strategy helps to promote credibility and confidence in the ESCB's monetary policy at the outset of EMU, the more effective that policy will be - and the easier the ESCB's task of maintaining price stability will become.

In deciding upon the appropriate monetary policy strategy, the following aspects must be seen as essential requirements. The strategy must:

* reinforce the ESCB's commitment to price stability, the

primary and over-riding task stipulated by the Treaty;

* it must clearly signal the anti-inflationary objectives of

the ESCB, and serve as a consistent benchmark for the

monetary policy stance; and,

* it must be transparent and explained clearly to the general

public - only then can the strategy serve as a basis for the

ESCB's accountability to the public at large.

The realisation that achievement of an optimal, non-inflationary macroeconomic outcome may founder on the private sector's distrust has been central to the monetary policy debate of the nineteen-eighties and 'nineties. The search for answers to the questions raised by this debate has spawned an enormous economic literature. The keywords "time inconsistency" and "credibility" draw forth an almost unmanageable flood of publications that have appeared in the wake of the pioneering contributions of Kydland / Prescott and Barro / Gordon.

The need to establish a credible and consistent monetary strategy in the face of the well-known time inconsistency problem faced by policy makers - the dilemma highlighted by this economic literature - is especially important for the ESCB at the outset of Monetary Union. As a brand new institution, the ESCB will have no track record of its own.

Building its reputation, and the associated credibility of monetary policy, is vital. But the process of doing so is complicated by the relatively high level of uncertainty surrounding the transition to Monetary Union itself. The transition to Stage Three is a unique event, and will create unique opportunities for many - but it will also create some unique problems for monetary policy makers. At the ECB, we are addressing these problems and are confident that the risks can be managed successfully. Many of the difficulties we face will be overcome through our own efforts over the coming months.

Among these problems are the difficulties involved in creating a comprehensive and accurate database of euro area-wide statistics. Running a single monetary policy for the euro area requires timely, reliable and accurate euro area data. In some cases, the euro area statistics simply did not exist until quite recently. In others, the statistics are based on new concepts, and the properties of the data series are not yet well known. The long runs of high quality back-data required for empirical economic analysis may be unavailable. Those that do exist are likely to have been constructed using some degree of estimation and judgement, possibly rendering the econometric results produced with them questionable.

Furthermore, the regime shift associated with the adoption of the single monetary policy may change the way expectations are formed in the euro area, and thereby alter forward-looking economic behaviour. Monetary policy's effects on consumption, investment, and wage bargaining - and therefore the whole transmission mechanism of monetary policy to developments in the price level - would be among the important economic relationships to be affected in this way.

This may be no bad thing. Indeed, using the regime shift implied by the transition to Stage Three to change both public and private sector behaviour in favourable directions may be one of the largest gains that the euro area can extract from Monetary Union. Nevertheless, these changes are likely to complicate the implementation of certain important elements of a monetary strategy, at least in the short term, as past relationships between macroeconomic variables may break down. What is good for the euro area economy as a whole may create some practical problems for the ESCB.

One example of this so-called 'Lucas critique' phenomenon is the impact of current, very low rates of inflation on private behaviour. For many countries participating in Monetary Union, there is simply no - or only very recent - experience of how the private sector will behave in an environment of sustained and credible low inflation. Instability in past relationships may result, should behaviour change in this new, low inflation environment. I have already argued that these structural changes will benefit Europe's citizens - price stability will allow markets to work more efficiently, thereby raising growth, and improving employment prospects. But these changes may also complicate the ESCB's assessment of economic and financial conditions.

These uncertainties - arising directly from the transition to Stage Three itself - are both compounded by, and inter-related with, the broader economic context in which Monetary Union will be established. The increasing internationalisation of the global economy, and the current rapid pace of technological change, have affected all sectors of the economy, and the banking and financial systems in particular. For example, at present there are many, inter-related innovations in the payments system, such as:

* the introduction of TARGET (directly related to EMU itself);

* greater technological sophistication of payments mechanisms,

as use of computers and information technology becomes more

widespread and advanced;

* the additional incentive for cash-less payments that may

arise from the fact that for some time to come -

approximately three years - the new euro-denominated notes

and coin will not come into circulation. In particular,

narrow monetary aggregates might be affected by this

development; and,

* increased competition among banks and settlements systems,

arising from globalisation and the breakdown of barriers

between previously segmented national markets, which may

drive down the margins and fees charged to customers.

At the ESCB we will need to keep abreast of these developments, both for their immediate impact on one of our "basic tasks" - promoting the smooth operation of the payments system - and because of their broader implications for the euro area economy. Reducing transactions costs in the way I just described will benefit European consumers and producers - but it may also change the indicator properties of monetary, financial and economic variables that national central banks have looked to as guides for monetary policy in the past.

Finally, in Monetary Union there will be some heterogeneity across countries within the euro area. Europe's diversity is one of its greatest assets. But this diversity is greater than is typically the case between different regions in the same country using a single currency. Nevertheless, the ECB Governing Council will have to concentrate on monetary and economic developments in the euro area as a whole when discussing and taking monetary policy decisions.

How should a monetary policy strategy be selected in this - for monetary policy makers, at least - potentially difficult environment? The EMI outlined a number of 'guiding principles' for the selection of a monetary strategy by the ESCB. Foremost amongst these was the principle of 'effectiveness'. The best monetary policy strategy for the ESCB is the one which best signals a credible and realistic commitment to, and ensures achievement of, the primary objective of price stability.

For many commentators, this criterion points unambiguously in the direction of so-called 'direct inflation targeting'. If monetary strategies are to be judged according to how well they achieve price stability, defined as a low rate of measured inflation, then advocates of inflation targets argue an optimal strategy would surely target this low inflation rate directly. These commentators would place explicit quantitative targets for inflation itself at the centre of the ESCB's monetary policy strategy. Their approach has been strongly endorsed in some academic and central banking circles.

But, in the current circumstances, a pure 'direct inflation targeting' strategy is too simplistic for the ESCB, and possibly even mis-conceived. The ESCB well understands the primacy of price developments and price stability for monetary policy making. Indeed, the Treaty's mandate is unambiguous in this respect. We will signal our intentions on this dimension very clearly by making a transparent public announcement of our definition of price stability. The current low level of long-term nominal interest rates in the euro area suggests that the financial markets, at least, understand and believe the over-riding priority that we attach to achieving price stability.

Regarding strategy, our choice therefore need not be governed solely by a desire to signal our intent to maintain price stability. This has already been well-established - by the Treaty, and by the success of the convergence process in reducing inflation in Europe to its current low level. Rather than signalling our intent, the strategy must constitute a practical guide that ensures monetary policy is effective in achieving the goal we have been set.

In this respect, there are considerable problems with using inflation itself as the direct target within the ESCB's overall strategy. Because of the well-known lags in the transmission mechanism of monetary policy to the economy in general, and the price level in particular, it is impossible for a central bank to control inflation directly. Therefore, 'inflation targeting' in practice means 'inflation forecast targeting' where central banks set monetary policy to keep their best forecast of inflation at the target level deemed consistent with price stability.

But recognition of this need for forecasts in an inflation targeting strategy immediately raises practical difficulties. In the uncertain environment likely to exist at the outset of Monetary Union, forecasting inflation will be very difficult, not least for the conceptual, empirical and practical reasons I outlined a moment ago. Forecasting models estimated using historic data may not offer a reliable guide to the behaviour of the euro area economy under Monetary Union. Forecast uncertainty is likely to be relatively large, possibly rendering the whole inflation targeting strategy ineffective.

To address these uncertainties, a large element of judgement would have to be introduced into the forecasting process, in order to allow for the regime shifts and structural and institutional changes that are a seemingly inevitable consequence of EMU. Simply relying on historic relationships to forecast future developments is unlikely to prove accurate or effective. While introducing judgmental adjustments into forecasts in these circumstances would be both appropriate and necessary, such adjustments are likely to compromise the transparency of the inflation forecasts and, thus, of any inflation targeting strategy. Using judgement may prevent outside observers from readily assessing the reliability and robustness of the inflation forecasting procedures used by the ESCB.

I see a distinct bias in the academic discussion of the comparative advantages of inflation targeting and monetary targeting. With good reason, many arguments are presented against the ESCB adopting a monetary target. But proponents of inflation targeting seem to forget that, in the current context, most of these arguments could also be used against inflation targeting. Above all, I have not seen any attempt thus far - even if only a tentative one - to explain how the ESCB should deal with the specific difficulties involved in making an inflation forecast at the outset of Monetary Union that could be used as the centrepiece of an inflation targeting strategy.

In many respects, a strategy giving a prominent role to monetary aggregates has considerable advantages over direct inflation targeting. Monetary aggregates are published. They are clearly not subject to various kinds of 'judgmental manipulation' by policy makers or central bank staff that might be possible with inflation forecasts. To the extent that policy makers wish to depart from the signals offered by monetary growth because of 'special factors' or 'distortions' to the data - including those distortions arising from the transition to Monetary Union itself - they will have to do so in a public, clear and transparent manner.

Moreover, a strategy that assigns a prominent role to the monetary aggregates emphasises the responsibility of the ESCB for the monetary impulses to inflation, which a central bank can control more readily than inflation itself. These monetary impulses are the most important determinants of inflation in the medium term, while various other factors, such as terms of trade or indirect tax shocks, may influence the price level over shorter horizons.

In the light of these considerations, it was agreed at the EMI that, regardless of the final choice of the monetary policy strategy, monetary aggregates would be accorded a prominent role in the overall monetary framework adopted by the ESCB.

However, the EMI also noted that certain technical pre-conditions would have to be met before this 'prominent role' could be translated into an explicit, publicly announced monetary target, guideline, benchmark or monitoring range. Specifically, such targets or ranges would only be meaningful guides to monetary policy if the relationship between money and prices - as encapsulated in a 'demand for money' equation - was expected to remain sufficiently stable.

In this regard, several existing empirical studies point towards the stability of the demand for euro area-wide monetary aggregates. However, these studies are necessarily only preliminary. The reliability of these results in the face of the uncertainties raised by the transition to Stage Three is unknown. Future shifts in the velocity of money are certainly possible - perhaps even likely. They cannot be predicted with certainty. Moreover, it is not clear whether those aggregates that have the best results in terms of stability are sufficiently controllable in the short-term with the policy instruments available to the ESCB. In these circumstances, relying on a pure strategy of strict monetary targeting is simply too risky.

Against this background, the ESCB will have to design a monetary policy strategy of its own. The chosen strategy will show as much as possible continuity with the successful strategies that participating NCBs conducted in the Stage Two. At the same time the ESCB's strategy will take into account to the extent needed the unique situation created by the introduction of the euro.

Похожие работы

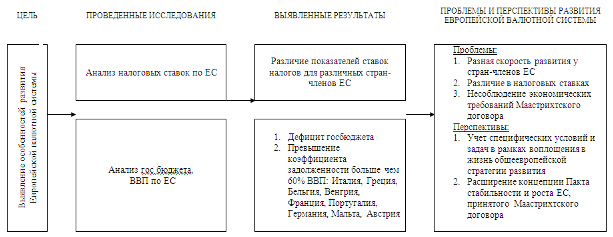

... путей сотрудничества стран Е.Э.С. - задача первостепенной важности на пороге двадцать первого века. . - 18 - 3II. Вопросы финансовой политики Е.Э.С. 22.1. Европейский бюджет. Европейский бюджет не перестает быть в центре внимания финансовых и экономических противоречий между странами-участницами. Такое положение ...

... " не смогли утвердиться. Необходимо было немедленно найти иной вариант реализации европейской валютной системы, который бы уравновесил национальные и интеграционные интересы государств. 4. Европейская валютная система: первый шаг к истинной валютной интеграции. Инициаторами создания ЕВС были канцлер ФРГ Гельмут Шмидт и президент Франции Валери Жирак д'Эстена, которые представили эту идею ...

... 9. Евростат // Дефицит бюджета в еврозоне (данные 2008 года) // Режим доступа [http://ec.europa.eu/eurostat] 10. Сайт Европа. История денежно-кредитного сотрудничества (Европейская валютная система) // Режим доступа [http://europa.eu]; 11. Фонд экономического развития «Центр Экономикс». Европейский фонд межгосударственного валютного регулирования. Выбор режима валютного курса // Режим доступа ...

... США заставляют правительство Канады пристально следить за развитием событий на мировых валютных рынках. Начиная с 80-х гг. важнейшей целью валютной политики Канады была стабилизация обменного курса канадского доллара по отношению к доллару США. ДЕНЕЖНАЯ СИСТЕМА ИТАЛИИ.Денежная единица и денежное обращение. Денежная система Италии за свое многовековое существование ...

0 комментариев